2020 FEDERAL WITHHOLDING TAX TABLES

(*REVISED December 27, 2019)

The SkilMatch FIT tables were created using the IRS “early release” 2020

Percentage Method Tables for Automated Payroll Systems published December 2019. SkilMatch will notify you if there are

changes to the 2020 FIT tax table.

NEW January 2020: SkilMatch

programming installed to enable NEW 2020 W4 compliance. The NEW 2020 W4 requires the NEW Federal tax

setup options starting January 1, 2020. You must update the Federal

tax tables AFTER your last payroll checks dated in 2019 and BEFORE your

first payroll checks dated in 2020.

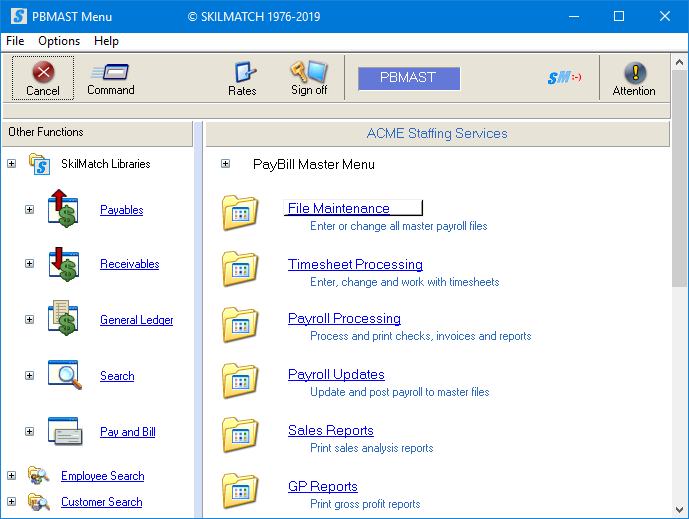

Change your FIT tables in ALL Temp

payroll companies. Staff payroll in the

same company will share the table.

2020 Federal tax tables changes:

1)

2020 Federal tax

table 01, “FIT-STANDARD” includes a NEW “Head of household” table.

2)

2020 Federal tax

table 01 requires the standard deduction for calculating employee’s tax. NOTE:

2020 Federal tax table 02 does NOT include a standard deduction.

3)

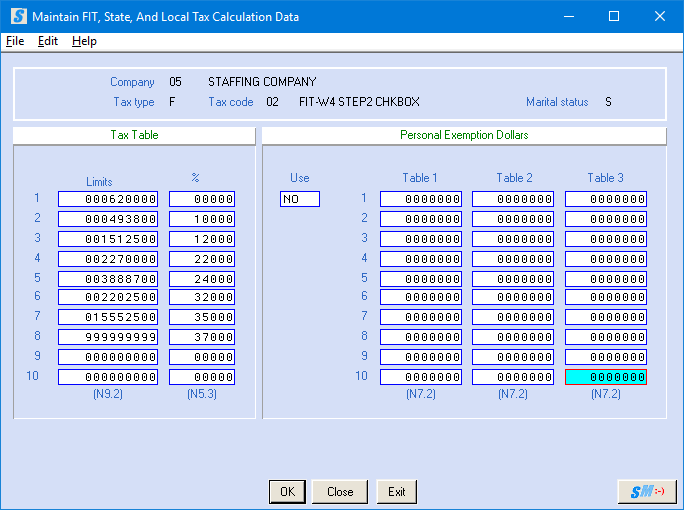

NEW

2020 Federal tax table 02, “FIT-W4 STEP2,

CHKBOX” for Married, Single and Head of household.

NOTE: PRELIMINARY

step REQUIRED before Federal 02 tax

tables can be entered into SkilMatch.

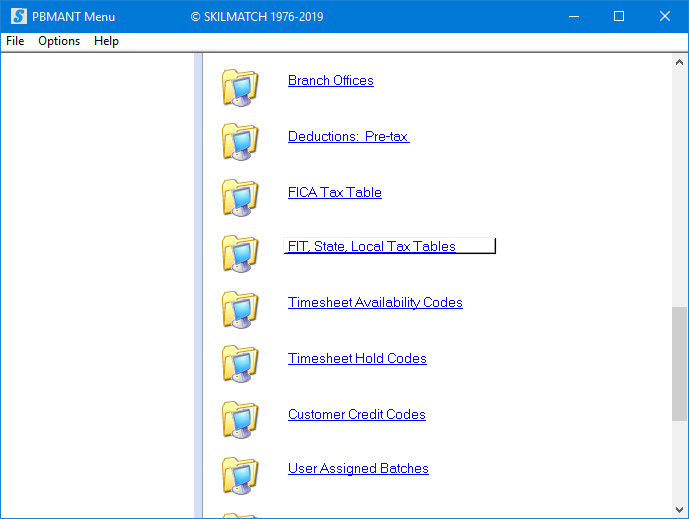

New PR GL Distribution code

needs setup for Federal 02-FIT-W4 STEP2 CHKBOX,

through Menu File Maintenance, Item PR GL Distributions.

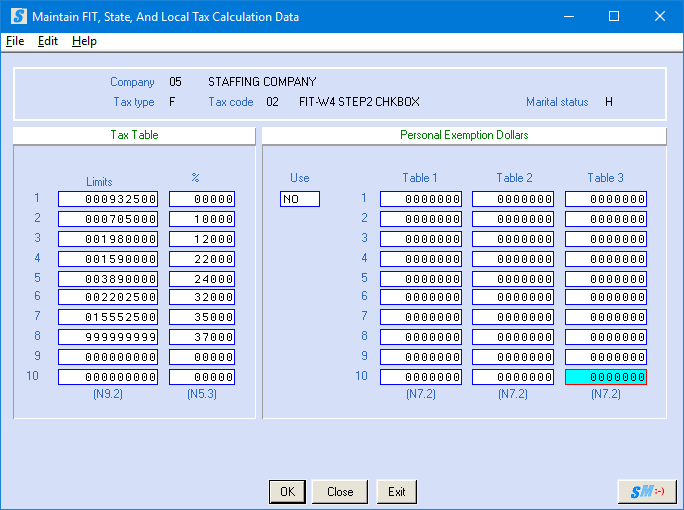

12/27/19 CORRECTED “Tax Table %”, changes have been

highlighted in yellow.

Tax Table % changes have been made on the following

tables:

Federal 01 – Head of household

Federal 02 – Married

Federal 02 – Single

Federal 02 – Head of household

NOTE: The tax rates were originally shown with one

zero missing, so the tax rate of 10% was entered as 1000 (1%) and should have

been entered 10000 (10%). All tax rates

should be reviewed and adjusted to match the tax tables below.

NOTE: Tax

table changes are effective for the company number entered. You will

need to REPEAT the

setup for ALL company

numbers for which you are calculating payroll taxes. Tax

tables will be effective for both Temp and Staff for this company number.

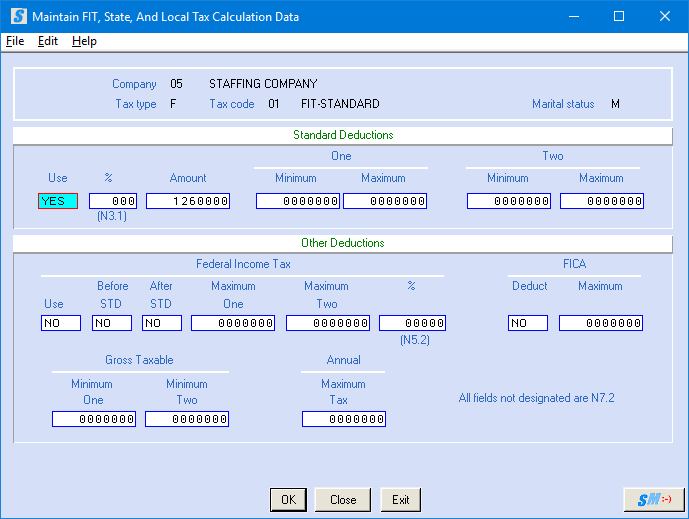

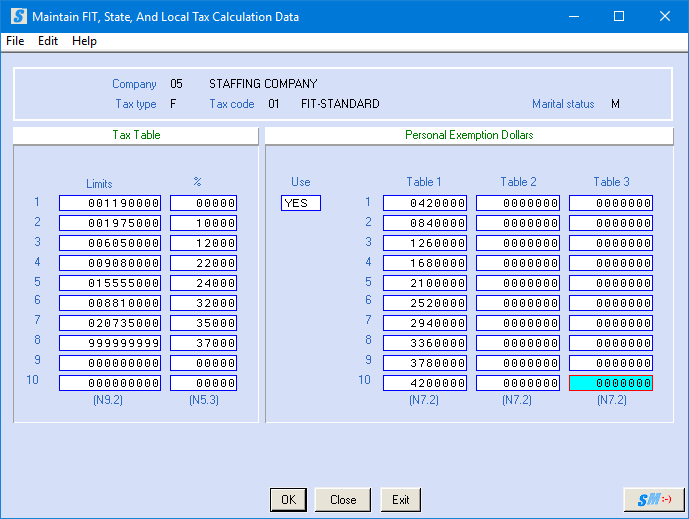

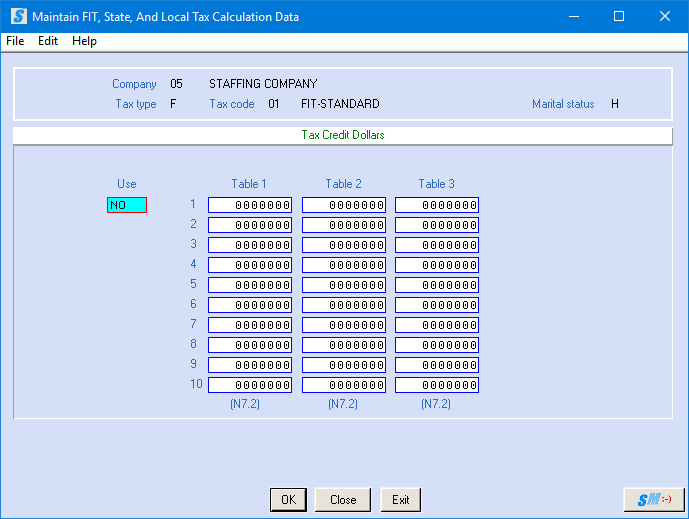

Federal Tax Table 01

“FIT-STANDARD”

MARRIED

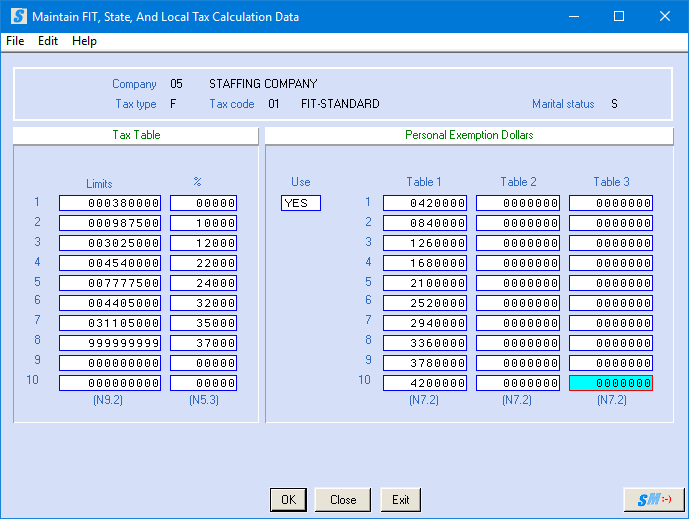

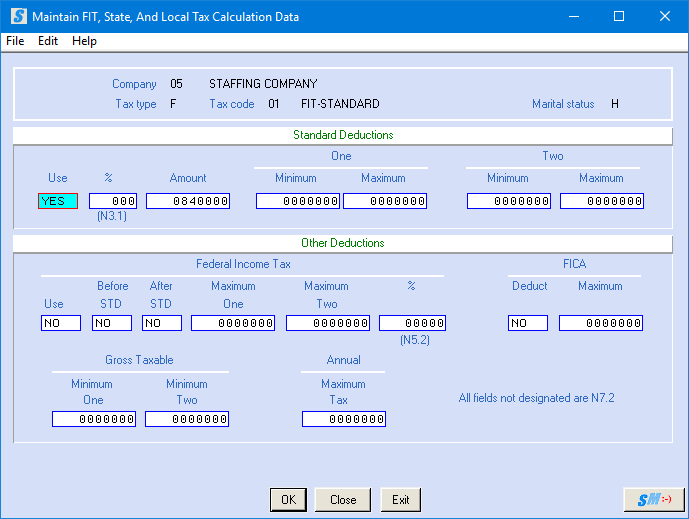

NEW: Federal 01 tax tables NOW

include a Standard Deduction for Married, Single and Head of Household.

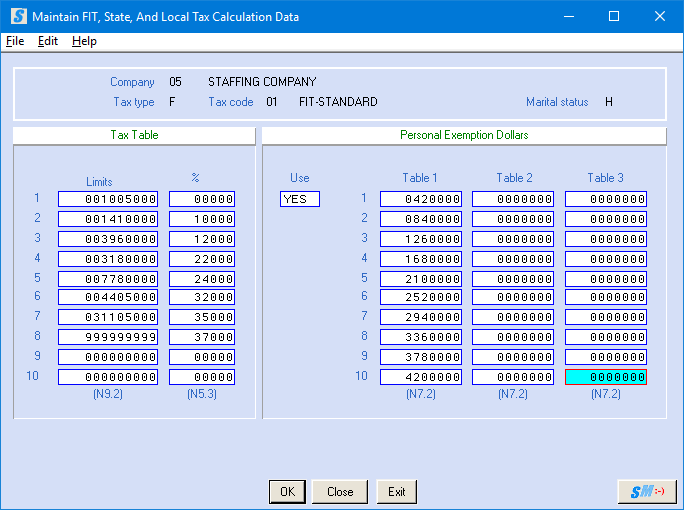

NOTE:

Federal 01 tax table continues to include Personal Exemption Dollars.

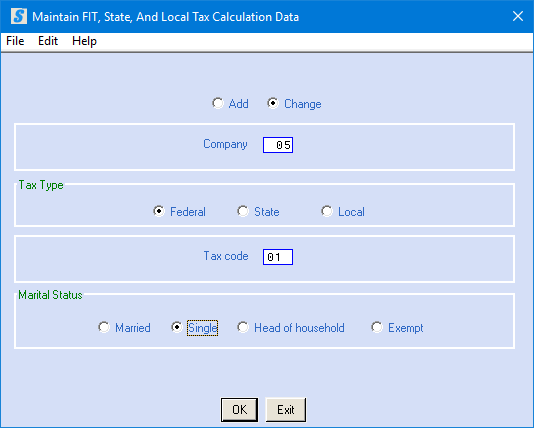

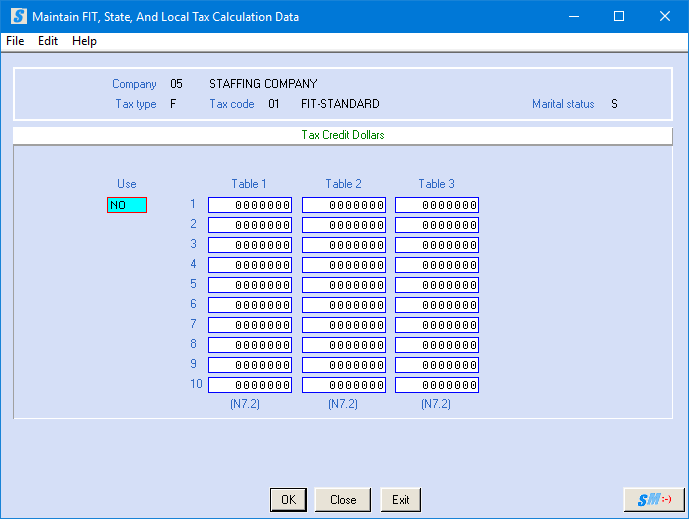

SINGLE – Federal Tax Table 01 “FIT-STANDARD”

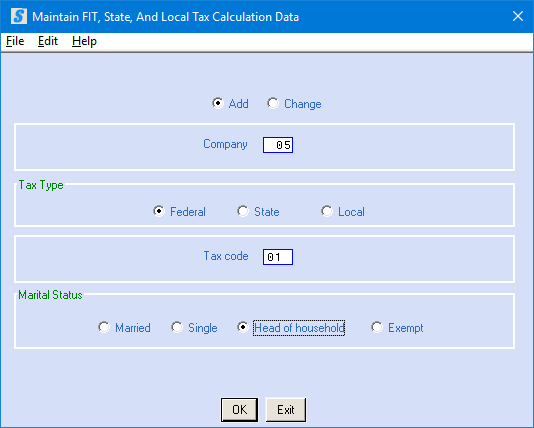

NEW HEAD of HOUSEHOLD – Federal Tax Table 01 “FIT-STANDARD”

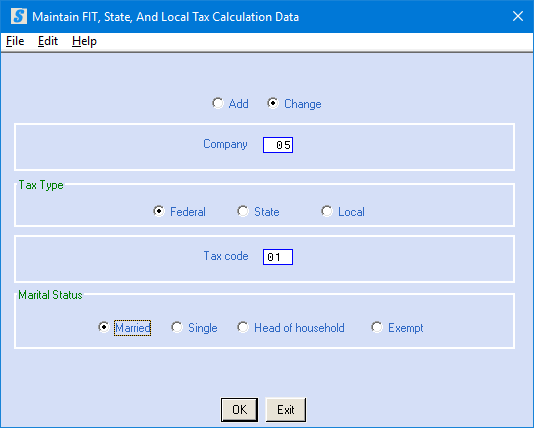

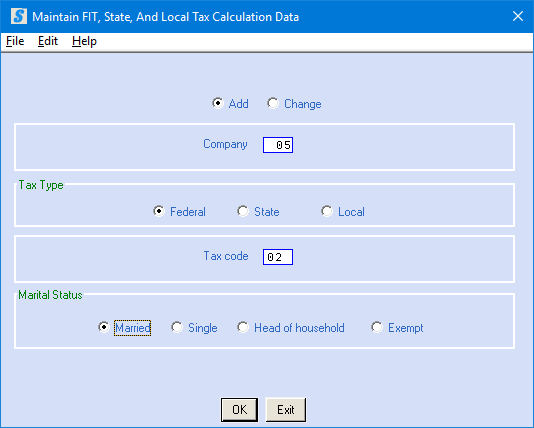

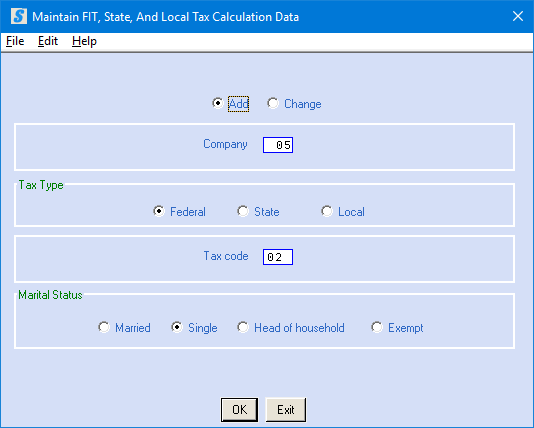

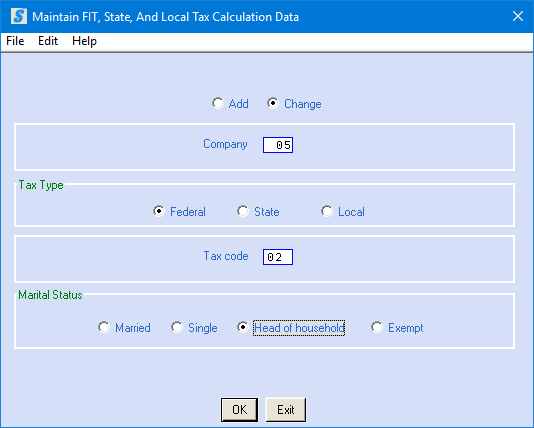

NOTE: If this is the first time you are entering data for Head of Household, you will need to

select the option “Add”.

*corrected

“Tax Table %” below

YOU

ARE NOT FINISHED – NEW FEDERAL 02 TABLES ARE ALSO REQUIRED FOR 2020 PROCESSING.

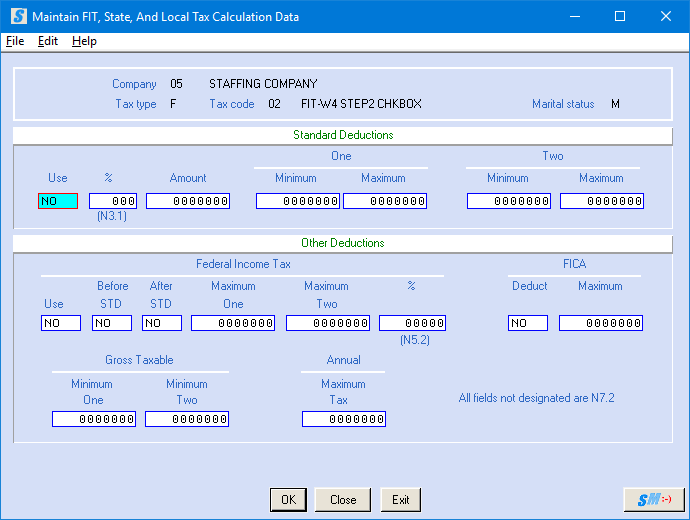

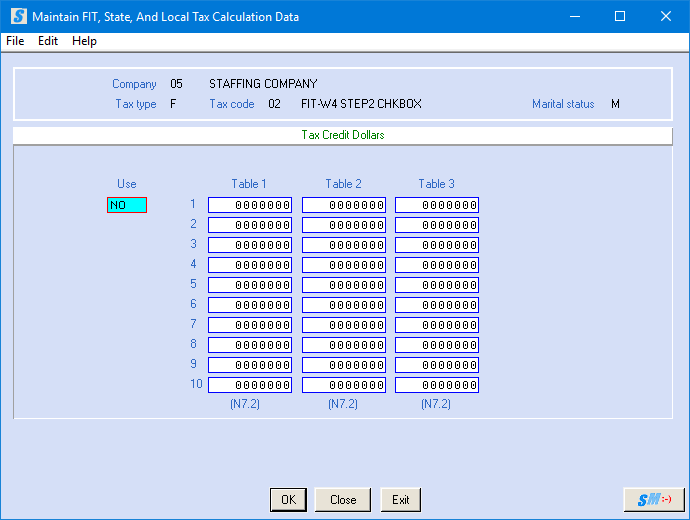

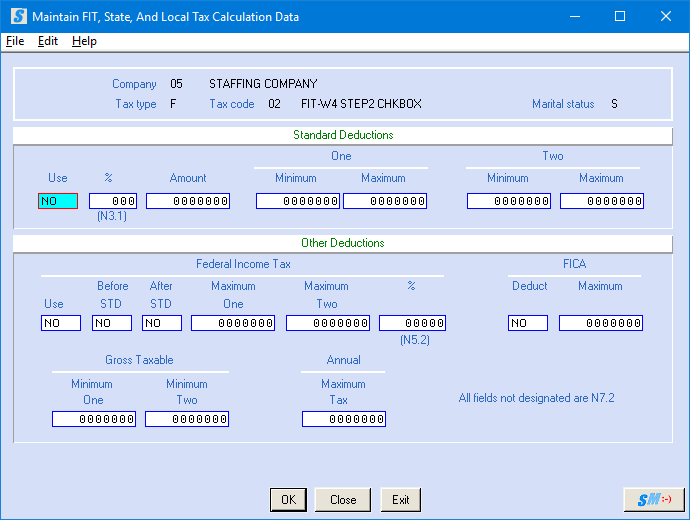

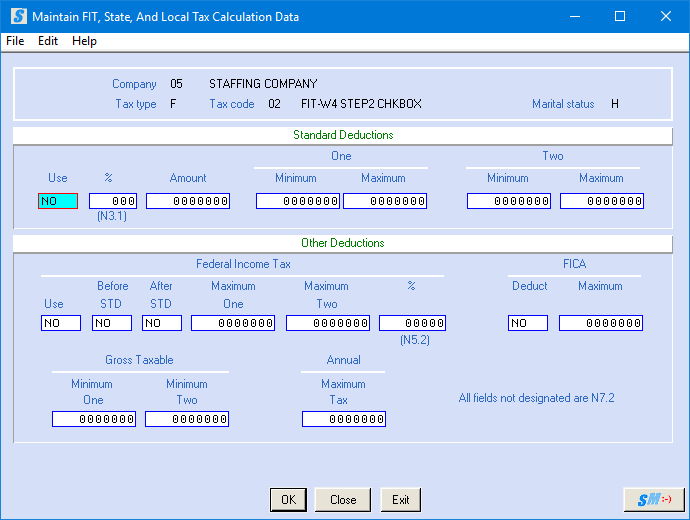

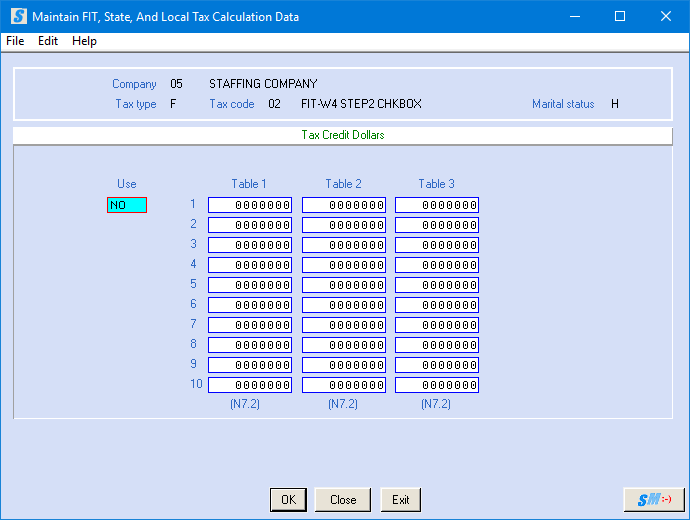

NEW Federal Tax Table 02

“FIT – W4 STEP2, CHKBOX”

MARRIED

REMINDER:

PRELIMINARY step REQUIRED

before Federal 02 tax tables can be setup.

New

PR GL Distribution code needs setup

for Federal 02, “FIT-W4 STEP2 CHKBOX” through Menu File Maintenance, Item PR GL Distributions.

NOTE: If this is the first time you are entering data for Federal Tax Table 02, Married, Singe and

Head of Household, you will need to select the option “Add”.

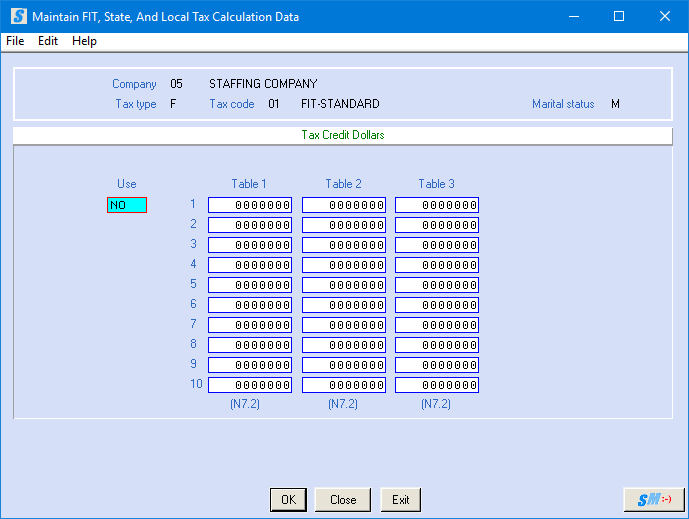

NOTE: Federal 02

tax tables do NOT include a Standard Deduction for Married, Single

and Head of Household.

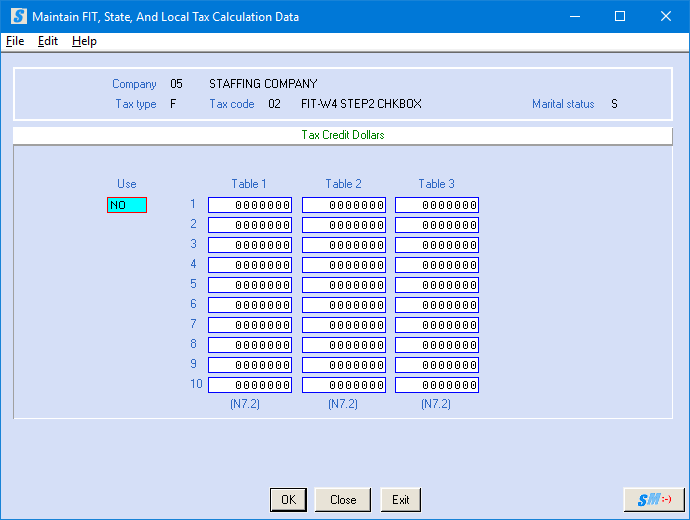

NOTE: Federal 02 tax tables do

NOT include Personal Exemption Dollars.

*corrected

“Tax Table %” below

NEW SINGLE

– Federal Tax Table 02 “FIT-W4 STEP2 CHKBOX”

*corrected

“Tax Table %” below

NEW

Head of Household –

Federal Tax Table 02 “FIT-W4 STEP2 CHKBOX”

*corrected

“Tax Table %” below

NOTE: Tax

table changes are effective for the company number entered. You will

need to REPEAT the

setup for ALL company

numbers for which you are calculating payroll taxes. Tax

tables will be effective for both Temp and Staff for this company number.

LEGAL

DISCLAIMER and Customer Responsibilities:

When SkilMatch staff or a SkilMatch

program provides information, data, calculation, tax tables, magnetic media or

paper reporting to SkilMatch customers, a “best efforts” attempt has been made

by SkilMatch to verify that the information is correct as SkilMatch understands

it or as it has been explained to SkilMatch.

SkilMatch-provided tax tables and reporting are provided to assist

customers in setting up your tax table records and to assist customers in

reporting to government authorities. Tax

laws and requirements change frequently and it is a customer’s responsibility

to verify the accuracy of all SkilMatch-provided information and reporting with

your tax advisor, accountant and/or attorney.

SkilMatch attempts to monitor

for tax table and reporting changes.

However, when a customer receives ANY notification of change from a

taxing authority, SkilMatch should be notified.

SkilMatch depends on customers who are closest to the taxing authorities

to provide information that will affect their businesses. Any and all written, verbal or electronic

information provided by SkilMatch regarding tax tables and government reporting

(1) is meant to provide general information about the payroll process, (2) is

not intended to provide tax or legal advice, (3) is not intended to address, and

is not meant to address, the entire body of federal, state and local law and

regulation governing the payroll process, payroll taxes, government reporting

or employment law. Such laws and

regulations change frequently and their effects can vary widely based upon

specific facts, circumstances and timing.

Each customer is responsible for consulting with a professional tax

advisor, accountant and/or attorney concerning its specific concerns and

compliance.