DATA ENTRY OF GENERAL LEDGER JOURNAL ENTRIES

While most entries into the

SkilMatch general ledger are posted automatically as a result of other

SkilMatch accounting functions, you will have journal entries that must be

posted manually. This option allows you

to enter, then edit, journal entries before posting into the general

ledger. When you exit this option, the

system will create a General Journal Transaction edit report (named GL110) that

will display in your outqueue.

SINGLE BATCH AT A TIME:

Only a single data entry

batch is permitted at any given time.

This does not mean one batch per G/L company number; it means one single

batch whose entries belong to the same fiscal month and year, and are within

the same G/L Company. If you have

entries that need to be posted to more than one fiscal month/year or different

G/L company numbers, then you will need to enter, edit, then post one batch

before starting the data entry of another.

REFERENCE NUMBER REQUIRED:

When entries get posted

automatically to the general ledger through other SkilMatch accounting

functions (like Accounts Receiveable or Cash Disbursements), the program

assigns a 2-character source code and a 2-digit batch number. The 2-digit number (00-99) is assigned in

sequential order, and when the number gets to 99, the system will start over

again with 00.

The source codes are:

AR = Accounts Receivable

invoices

CR = Cash receipts

AP = Accounts Payable invoices

CD = Cash Disbursements

PR = Payroll (used for both temp

payroll and staff payroll)

When reviewing General Ledger

Distribution reports, you can easily identify how the entry got into the

general ledger by looking at the source code and batch number. Example:

AR55 means the posting is A/R Invoices, and the detail of the posting is

on Batch 55.

For manually posted journal

entries, the system assigns a source code of GL. The system does NOT, however, assign a batch number. Instead, you will be asked to assign a 3-digit

reference number to each entry. With

the exception of 000 and 999 (which are restricted for program use), any number

from 001-998 may be assigned.

SkilMatch recommends that you

create your own list of reference numbers to use with manual journal

entries. These reference numbers are

not mandated by SkilMatch, and are not pre-defined in any kind of a table. Reference numbers have 2 purposes: 1) to

assist you when reviewing Distribution reports to recognize the kind of entry

that was posted, and 2) for the system to match up the debits and credits of an

entry for balancing purposes. For

example, you might chose to reserve the number 001 for your annual “Beginning

Balance” entry. Number 200 could

indicate your monthly reallocation of corporate staff payroll expenses.

SkilMatch support staff will not

be able to tell you what your reference numbers represent since the system does

not require the numbers to be pre-defined.

You will need to review past postings in order to decipher the reference

number meaning.

The

following is a list of the different features described in this documentation:

How To Enter Beginning Balances For a New

Year

How To Enter Beginning Balances

Before The Year is Closed

New SkilMatch Customer Beginning Balance

entry

HOW TO ENTER or EDIT GENERAL JOURNAL DATA

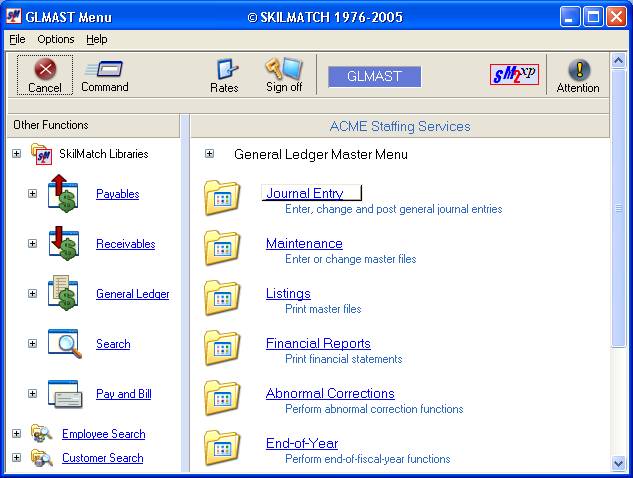

To

begin, on the “General Ledger Master” menu, click [Journal Entry].

The

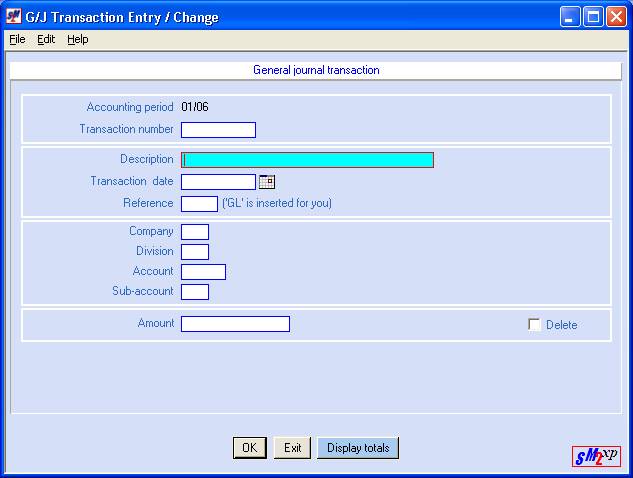

screen will display:

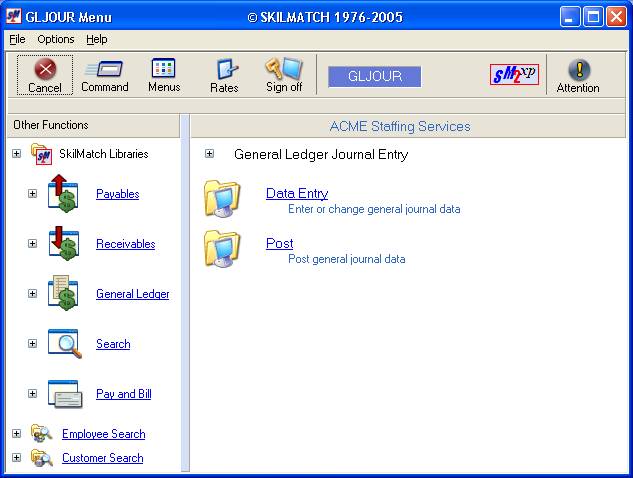

Click [Data Entry]. The screen will display:

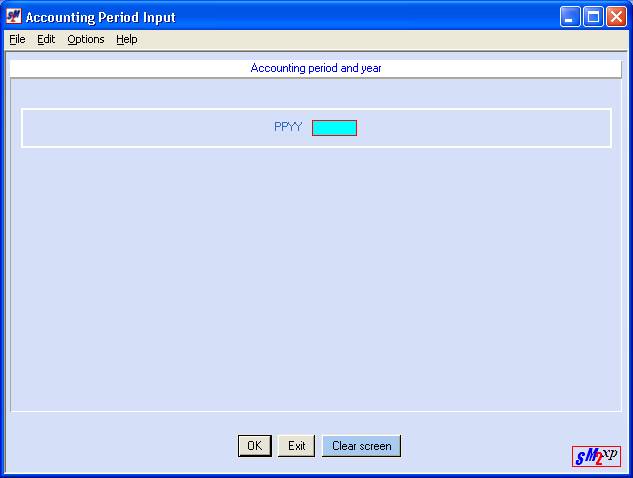

PPYY:

Key the fiscal period and year

to use when posting these journal entries

To proceed, click [OK].

To not proceed, click [Exit]. You will be returned to the “General Ledger

Journal Entry” menu.

If at any time during the entry

of data you wish to erase the screen and start fresh, click [Clear Screen].

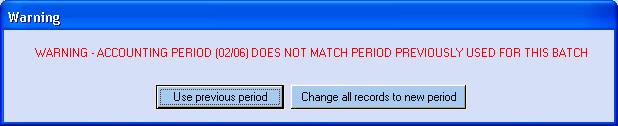

WARNING OF DIFFERENT

FISCAL DATES:

If you clicked [OK],

then the system will look to see if there is an unposted batch of journal

entries. If one is located, then the

system will check whether or not the existing batch is for the same fiscal

period and year. If the fiscal month or

year is different from the existing batch, the screen will display:

One of three situations

exists. Either you neglected to post

the previous batch, or you keyed the previous batch using the wrong fiscal

date, or you keyed the wrong fiscal date just now.

If you want the entries to post

using the period already in use, click [Use Previous Period].

If you wish to change the period

for the records already in this file to the period displayed in the warning

message, click [Change All Records

To New Period].

If you do not know what period

is currently in use, refer to the edit list produced when you last exited this

program. If you cannot locate the edit,

click [Use

Previous Period] to continue, then click [Exit]. From the Totals screen, click [Totals are

correct/End and return to menu]. You will be returned to the “General Ledger Journal Entry” menu,

and a new edit report will be created.

Use these same instructions if you need to cancel and post the existing

batch before adding new entries.

If the WARNING screen

does not display, then you will go straight into data entry. The screen will display:

(The cursor will be positioned

at Description, not Transaction number.

The Transaction number area is only used to bring up previously keyed

entries.) Key up to 30 characters of

description. The description will print

on the G/L Distribution source register.

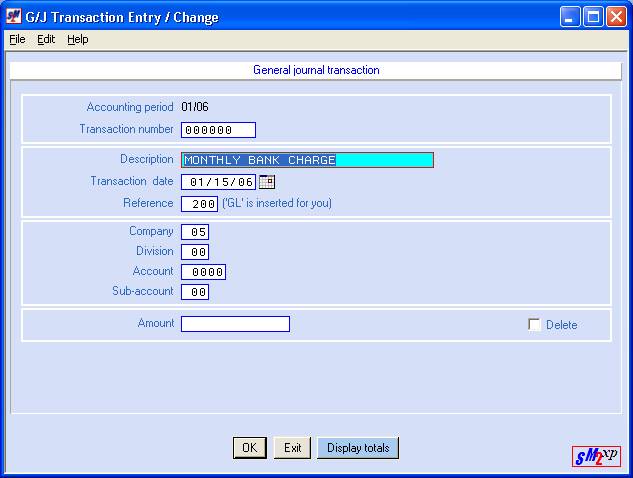

Transaction Date

Key the transaction date. Use the format MMDDYY.

OR

Select a

date by clicking the ![]() button (prompt and select button) to the

right of dates throughout SkilMatch2. The

button (prompt and select button) to the

right of dates throughout SkilMatch2. The ![]() button will display a calendar from which you

may click on a date to select, and then click [OK]

to key the date.

button will display a calendar from which you

may click on a date to select, and then click [OK]

to key the date.

Reference (GL is inserted for you)

Key a 3-digit number (001 to

998) to represent the type of entry you are keying. Do not use 000 or 999. (See discussion on reference numbers at

the beginning of this document.) You

must assign the same reference code to all entries that relate to the same

transaction. If you do not, the system

will find the entry out of balance. It

is not a problem to have multiple reference numbers in a batch.

Company

Key the 2-digit G/L company

number to which this entry will be posted.

Division

Key the 2-digit division

number (00 for balance sheet, 01-89 for income and expense account).

Account

Key the 4-digit account number.

Sub-Account:

Key a sub-account number, if

applicable, or key 00.

(To verify that you have keyed

the correct account number, press the <ENTER>

key after keying the sub-account number and the system will display the description

from the chart of accounts (to the right of the division field.)

Amount:

Key the amount of the item. Be sure to use spaces to hold zeroes, and do

not use a decimal point. If the amount

needs to have a minus sign, press the <->

key on the keypad to the right side of your keyboard after you have keyed the

amount. (Do not use confuse the

keyboard ‘dash’ with the keypad’s minus sign.)

Click [OK] to add this entry.

Click [Exit] to end data entry

without adding this transaction.

Click [Display totals] to check

the amounts of the debits and credits in this data entry batch.

If you selected [OK],

then a new screen will display with some of the data from the previous

screen. The cursor will be positioned

at description.

Since every transaction will

have a minimum of 2 entries, the system will bring forward data from the

previous entry to save you from having to re-key information. Use the <TAB>

key to move forward to the next area.

When you have completed the

screen, click [OK] to add this transaction.

Repeat the preceding

instructions for additional entries related to the same transaction. Remember that all entries pertaining to the

same transaction must have the same reference number!

Display Totals:

We recommend that you balance as

you go along. Click [Display

Totals] at the end of each complete transaction or at the end of

entries for a specific reference number.

The screen will display:

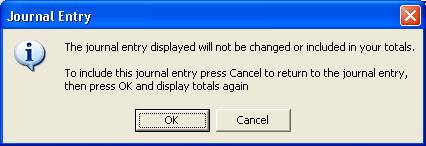

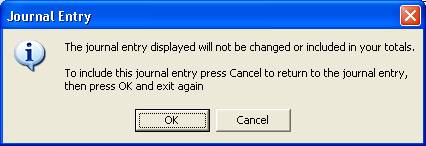

This window serves as a reminder

that if you did not click [OK] on the previous screen, then your entry

has not been added, and will not be a part of the upcoming totals. Either click [OK] to continue without

adding the entry displayed, or click [Cancel] to add the transaction before

continuing to the totals screen.

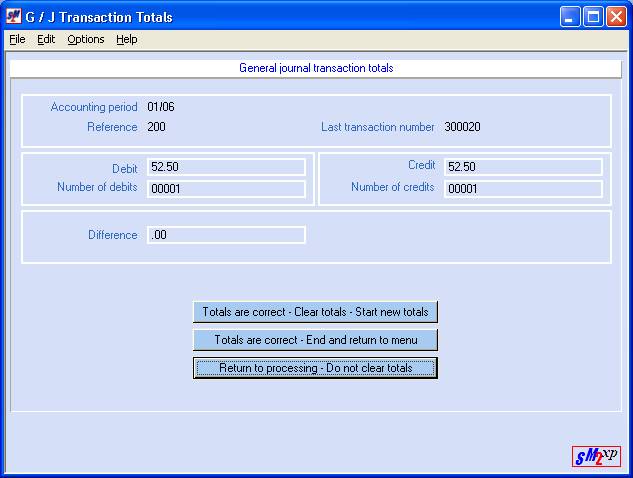

Once you have clicked [OK] on the reminder screen, the totals screen

will display:

TOTALS ARE CORRECT-CLEAR

TOTALS-START NEW TOTALS

(The

system will automatically start a new set of totals when you change to a new

reference number.)

If the amounts are correct, and

you wish to zero out the totals before continuing, click [Totals are correct-Clear totals-Start new

totals].

TOTALS ARE CORRECT-END AND

RETURN TO MENU

If the amounts are correct, and

you are finished with entry, or you are finished for now, but want to add more

entries later (before posting), click [Totals are correct/End and return to menu].

RETURN TO PROCESSING-DO NOT

CLEAR TOTALS

If the amounts are correct and

you wish to continue with entry without resetting the amounts back to zero,

click [Return

to processing/Do not clear totals].

If the amounts are incorrect,

and you wish to correct them, click [Return to processing/Do not clear totals].

CHANGING OR DELETING AN EXISTING ENTRY:

If your totals were not correct,

you may re-access the entry screens to make corrections. To bring up an existing entry, you must key

a transaction number assigned by the system.

Each entry is assigned a Transaction number in multiples of ten (010,

020, 030, 150, 870, etc).

If the entry has not been

through an edit process, when occurs when you end and return to menu, then you

will add a 300 to the beginning of the transaction number. The first entry is 010, the second is 020,

etc with the number 300 attached to the beginning of the number (example 300010,

or 300020). Make your best estimate of

the entry you wish to view.

If the entry has been through an

edit process, then you should refer to the edit report to obtain the current

Transaction number. The system will

group together all entries that belong to the same Reference number. This means that the Transaction number

assigned to an entry could change each time the batch is edited.

It would not be unusual to have

a current entry with a transaction number of 300010, as well as an existing

entry with a Transaction number of 10.

<TAB> the cursor back to Transaction

number and key the number. Click [OK] after you have keyed the Transaction number.

CHANGES: Use the <TAB> key to

position your cursor in the area that needs a change. Make the necessary changes, then click [OK]. Click [Display Totals] again to re-verify your

batch totals.

DELETION: If necessary, you may delete an existing

entry or a partially keyed entry. Once

the entry is displayed, click once on the box beside DELETE to select (a

checkmark will display next to the selection).

Click [OK]. The item will be deleted and your cursor

will return to Description.

EXIT AND RETURN TO MENU:

When you have finished entering

new items, and correcting or deleting existing items, click [Exit]

to end data entry. The system will display

the reminder screen:

This window serves as a reminder

that if you did not click [OK] on the previous screen, then your entry

has not been added, and will not be a part of the upcoming totals. Either click [OK] to continue without

adding the entry displayed, or click [Cancel] to add the transaction before

continuing to the totals screen.

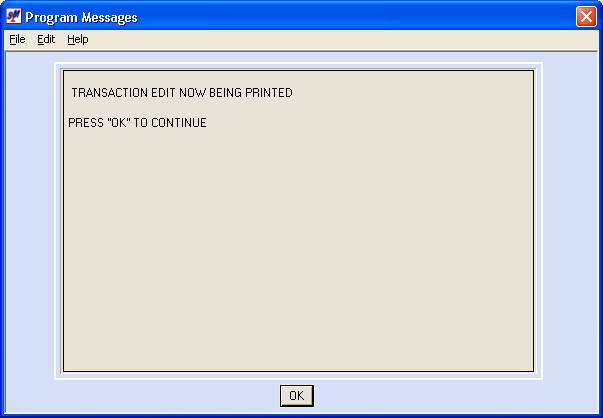

Once you have clicked [OK] on the reminder screen, the totals screen

will display. Click [Totals are

correct-End and return to menu]. The screen will display:

Click [OK]. You will be returned to the “General Ledger

Journal Entry” menu. A ‘General Journal

Transaction Edit (GL110) will display in your outqueue. Please review this report carefully to make

certain you are in balance and there are no error messages, before proceeding

to the posting option.

BEGINNING

BALANCES FOR NEW FISCAL YEAR AFTER CLOSING THE OLD YEAR

Beginning balances are not automatically brought

forward when a fiscal year is closed.

Beginning balances are entered manually.

You will need information from 3

reports – (1) the final Trial Balance report that was produced as part of your

closing year steps, and the final Financial Statement of the year that was

closed. (The first step of closing the

year was producing a final Trial Balance; this is the report you need, NOT one

produced afterwards). Your beginning

balances are put in only for asset and liability accounts (1,000, 2,000 &

3,000 accounts). You will use the

figures in the YTD ACTUAL column on the Trial Balance. (2) You will need the net loss/gain figure

from the final Financial Statement of the fiscal year that was closed. (3) Print a copy of your G/L Tailoring

file. You need to see whether the net

loss/gain figure on the financial statement has been set to reverse the sign (positive

or negative) when the statement is printed.

You will need this information when keying the journal entry.

Beginning Balances are entered

into the system as a journal entry.

Using the Trial Balance, you will key an entry for each account number

below 4000 that has an amount in the ‘YTD Actual’ column. These figures represent the beginning

balances for the new fiscal year.

Complete the entry screens as follows:

Accounting Period And Year:

Key 01xx (where xx denotes the

new fiscal year).

Description:

We recommend you use

"Beginning Balance "FY xx" (where xx denotes the new fiscal

year).

Transaction Date:

Key the last day of the previous

fiscal year. If you are entering

beginning balances for fiscal year '06, use 123105 as the transaction date. This will place this entry at the beginning

of your GL entries on your GL Distribution List reports.

Reference:

Key the number you have decided

to use to represent beginning balances.

(Do not use 000 or 999.) Use the

same reference number on all of the beginning balance entries.

Company/Division/Account/Sub account

Make an entry for every account

number below 4000 that has an amount in the YTD ACTUAL column on the Trial

Balance.

Amount:

Key the figure from the Trial

Balance, and press <+> or <-> as it appears on the report. (Use

the plus and minus keys on the keypad, not the ones to the left of the <BACKSPACE> key.)

Click [OK]

after each entry.

After you have made an entry to

all of the accounts numbers below 4000, you will need to make a second entry to

the RETAINED EARNINGS PRIOR account.

The amount of the entry is the “net loss/gain” figure from the final

financial statement. Key the amount

with a plus or minus sign as it appears on your statement UNLESS the Tailoring

report shows that the natural sign has been deliberately reversed. If the sign was reversed when being printed,

then you will key the amount using the opposite sign.

Example – if the statement shows

an amount of ‘200.00’, and the tailoring does not reflect a reversal of the

sign, then you will enter the ‘200.00’ as it was printed - a positive amount.

If the statement shows

‘–200.00’, and the tailoring says that the sign is reversed, then you will

enter the amount as a positive ‘200.00’.

(FYI – You will not make an

entry into the CURRENT RETAINED EARNINGS account- this account exists as an

internal calculation file only)

When all entries have been

keyed, and your edit is in balance and without error, you will post the entry.

ENTER

BEGINNING BALANCES FOR NEW FISCAL YEAR PRIOR TO CLOSING THE OLD YEAR

Beginning balances are not automatically brought

forward when a fiscal year is closed.

Beginning balances are entered manually.

Many companies do not close a

fiscal year until they after they receive their final adjusting entries from

the CPA and the tax return is filed.

Since this could mean a delay of several months, the net effect would be

incomplete financial statements for the new fiscal year. (You would only have current year figures in

your asset/liability accounts if you ran financial statements for the current

year.)

If you wish to have "almost

accurate" financial statements for the current fiscal year prior to

closing the previous year, then you can enter a set of estimated beginning

balance figures, and later make an additional set of entries to adjust the

original posting.

To achieve this, you should

produce a Trial Balance for the last month and day of your prior fiscal year,

and a financial statement for the entire year.

YOU NEED TO RETAIN THESE REPORTS PERMANENTLY AND HAVE THEM ACCESSIBLE

FOR FINAL ENTRIES. Enter beginning

balances only for account numbers less than 4000. Use the figures in the YTD ACTUAL column from the Trial Balance,

and the net loss/gain figure from the financial statement. Use the beginning balance entry instructions

listed above in keying your beginning balance entries.

When you receive the final

figures from your accountant, make your final entries to the fiscal year,

produce the final Trial Balance and financial statements, and close the

year. Using the journal from the

posting of the estimated beginning balances, reverse the original

entries and post. Then, using the

figures from the final reports, key a new set of beginning balance

journal entries and post.

NEW

SKILMATCH CUSTOMERS - HOW TO ENTER BEGINNING BALANCES WHEN FISCAL YEAR HAS

ALREADY BEGUN

For new customers who are

starting on the SkilMatch system in the middle of a fiscal year, you have two

choices in getting beginning balances into SkilMatch.

(1) Enter a total YTD balance for each account, using a

transaction date of the last day of the final month before going on

SkilMatch. You will need a final Trial

Balance and financial statement from the other system. Your beginning balances are put in for EVERY

account (asset, liability, income and expense). You will enter a YTD figure for each of these accounts.

-OR-

(2) Enter a month-to-date balance for each account, for

each month prior to going on SkilMatch.

This method is necessary if you want to run financial statements on

SkilMatch that include the months previous to being on SkilMatch. You will need to have a Trial balance,

financial statements, and posting information that includes detail for every

asset, liability, income and expense account for each fiscal month of the year

that occurred before you started using SkilMatch. You will have to make a separate journal entry for each month,

posting one month before starting another.

Regardless of which method you

chose, you will use the same beginning balance data entry instructions as

listed above.