DIRECT DEPOSIT MAINTENANCE:

Employee

Each employee who will

participate in Direct Deposit must have personal bank account data keyed into

their employee file. Most users will

not use this menu to setup or change employee bank account information. Instead, you may access the bank account

screens through the standard Employee menu option on the Pay and Bill

Maintenance menu, or by locating the employee using the Employee search and

selecting the Data Entry option.

Note: this option requires special interface programming which must be purchased/installed to enable use.

Direct Deposit Overview

When an employee's paycheck hold

code is entered as *D (*D being a valid hold code for the company), an

additional set of screens will be added to their employee file. This screen contains the direct deposit

data.

An employee can chose to have

their net pay deposited directly into their bank account(s) rather than

receiving printed paychecks. A special

hold code, when keyed into the employee file, will cause an additional screen

of data entry to display. Set up one or

more bank accounts for the employee. A

person can deposit pay into a single bank account, or in up to 3 different bank

accounts. When payroll checks are

printed, direct deposit participants will receive a ‘voucher’ rather than a

standard payroll check. The information

printed on the ‘voucher’ pay stub is the same as a standard paycheck. After the normal payroll options are

completed, a file of direct deposit data is transmitted to your bank, and your

bank will forward the pay data to the employee banks.

If the employee wants to use

multiple bank accounts, two of the three accounts will be set up to receive a

specific dollar amount each pay period, and one account will be designated the

PRIMARY bank account and will receive the remaining dollars of the pay

period. This is true whether the person

receives one check or multiple checks in a pay period. Example, if the 2nd bank account

is set for $50, and the 3rd account for $25, and if the employee’s

net pay for the pay period is $200, then the PRIMARY account will receive

$125. If the employee’s net pay for the

week is $35, then the 2nd account will receive the entire $35, and

no deposit will be made into the 3rd account or the Primary Account.

Most participants will begin

this process with a pre-notification that allows the bank to verify the

employee’s direct deposit bank and account data without actually making a

direct deposit.

During the pre-note stage the

employee will continue to receive printed paychecks. A zero-amount direct deposit record will be created and sent to

the bank during the first payroll that is processed after the pre-note date in

the employee’s file.

The bank will either accept the

pre-note as valid or reject it. Most banks

will not notify you of acceptances, only rejections. If you have not received a rejection from the bank within a

designated time period (designated by your bank), then the pre-note can be

changed to active.

If the pre-note is rejected, the

bank will let you know. Generally,

rejection is due to invalid banking information. Make the necessary corrections to the personnel file and change

the pre-note date to the date that the next "test run" should begin.

Once the pre-note is accepted,

you will change the person's direct deposit status from pre-note to active

and will assign a date to begin actual direct deposit.

Should the person change banks,

or should the person's bank account data change, then the person will have to

go back to a pre-note status for the test period.

A password is required for

entering or changing direct deposit data.

(It is the same password used to process a "Begin Cycle" in

payroll - see SM2PBMANT14).

A person can be removed from the

direct deposit program by changing their paycheck hold code from *D to any

other valid hold code.

HOW TO SET UP EMPLOYEE DIRECT

DEPOSIT DATA

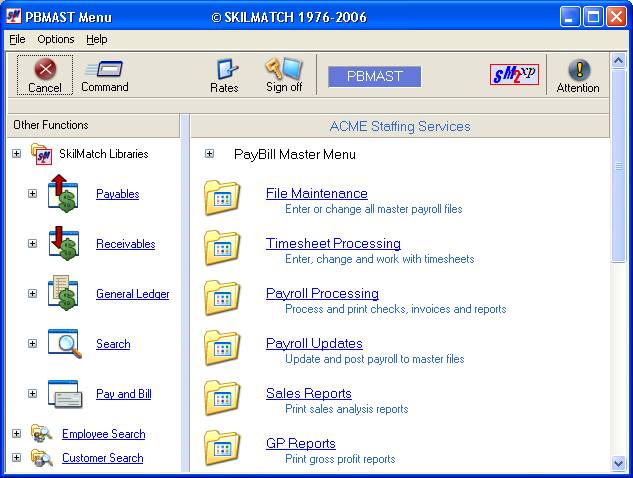

To

begin, sign on to the “PayBill Library Master” menu.

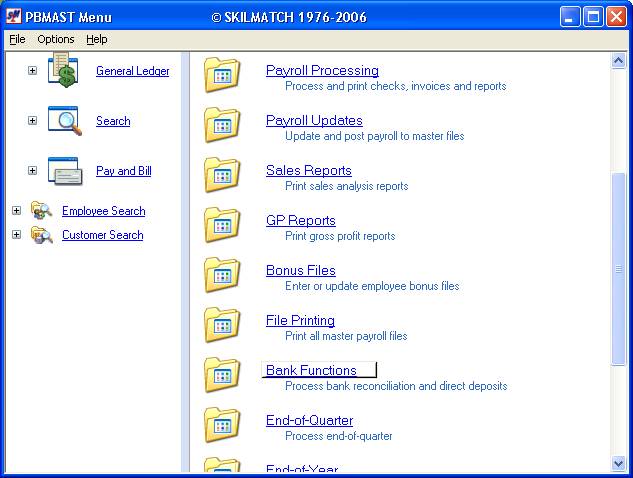

Right

click in the white space on the right side of the screen, or use the blue bar

to ‘drag’ down and display more menu options.

Click [Bank

Functions].

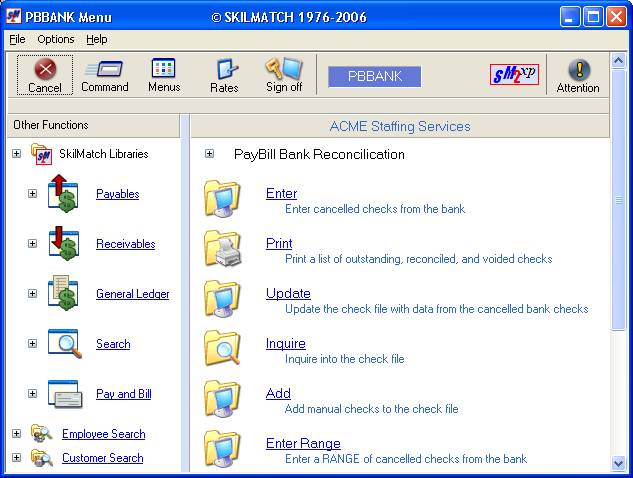

The

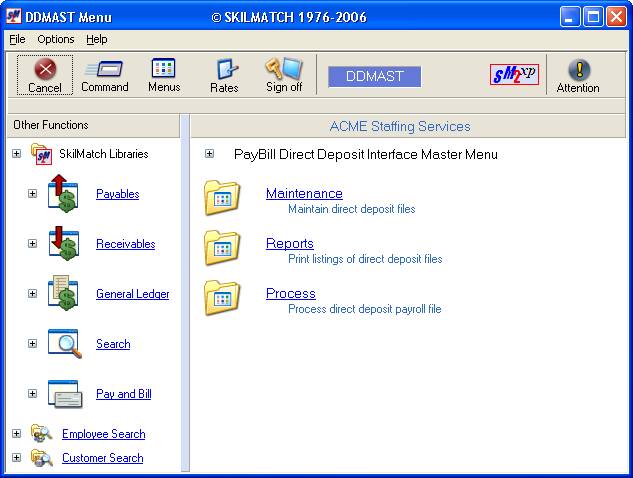

screen will display:

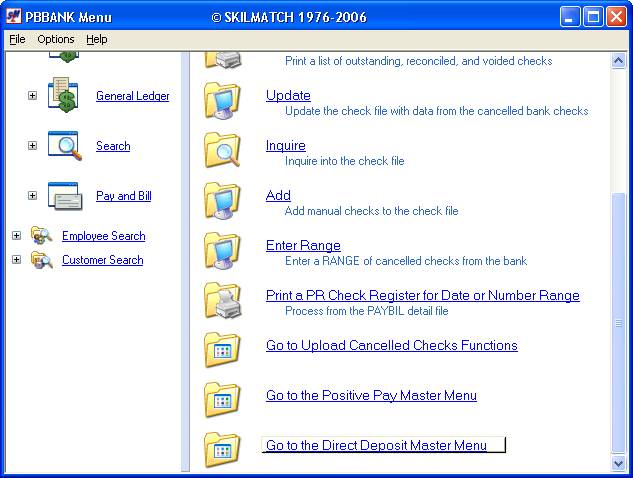

Right

click in the white space on the right side of the screen, or use the blue bar

to ‘drag’ down and display more menu options.

Click [Go to the

Direct Deposit Master Menu].

The screen will display:

Click [Maintenance].

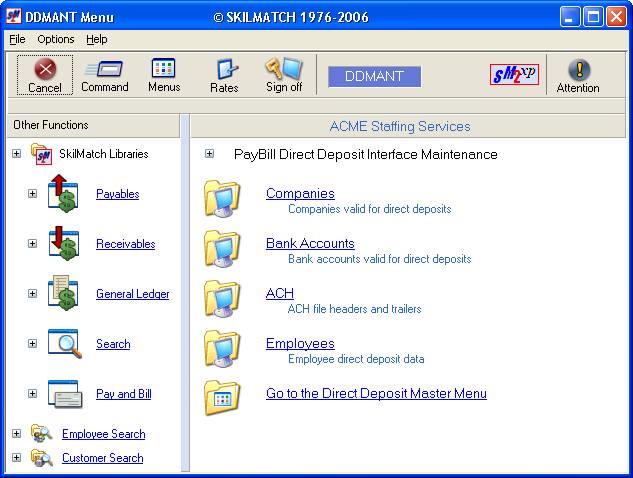

The screen will display:

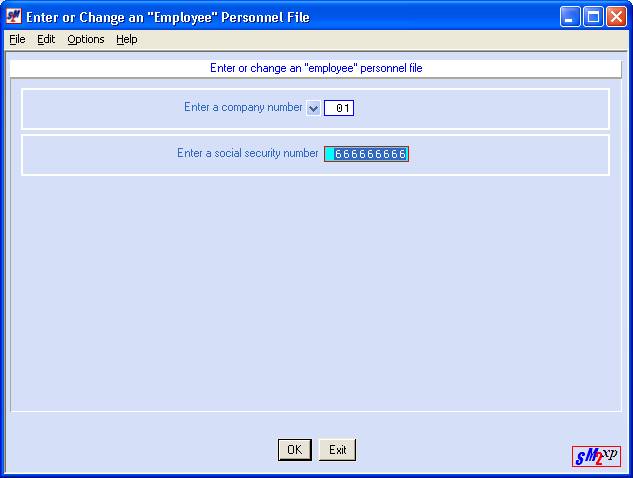

Click [Employees].

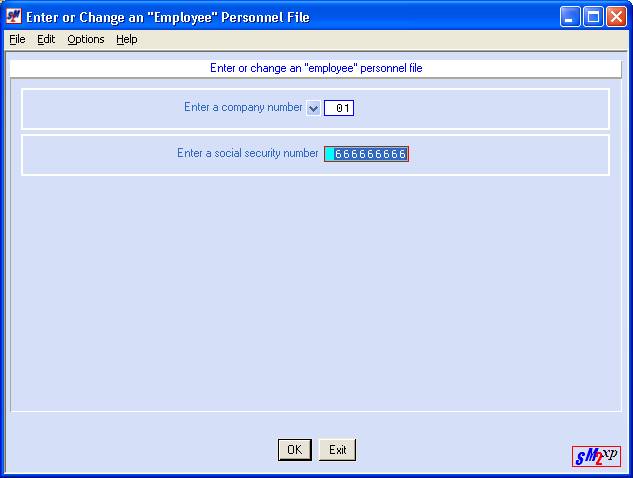

Company:

The system defaults to

Company 01. If you need to make direct

deposit additions or changes to an employee in a different company, <TAB>

back and change the company number.

Social

Security Number:

Key the employee’s

9-digit social security number and click [OK]. Click [Continue] repeatedly until the tax

detail screen displays:

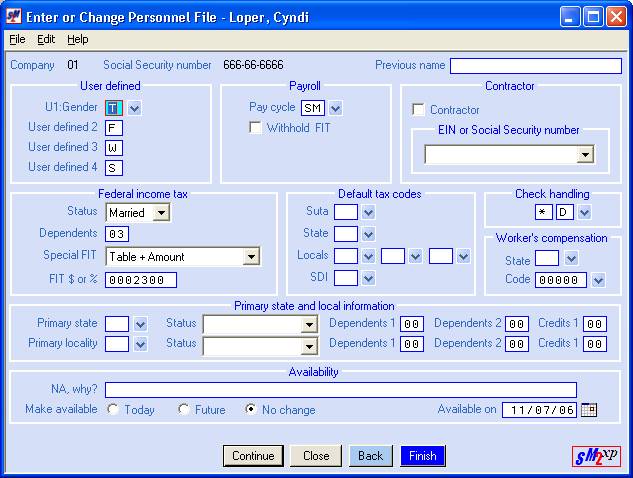

Check Handling:

Key *D as the paycheck hold code. Click [Continue].

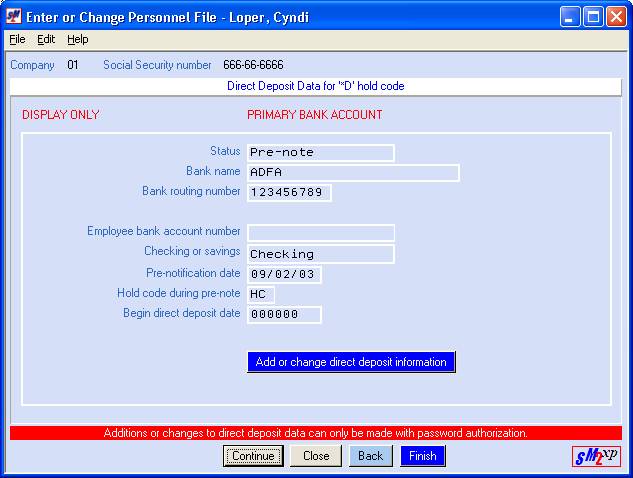

Changes:

If this employee already has

direct deposit data, the current data is displayed.

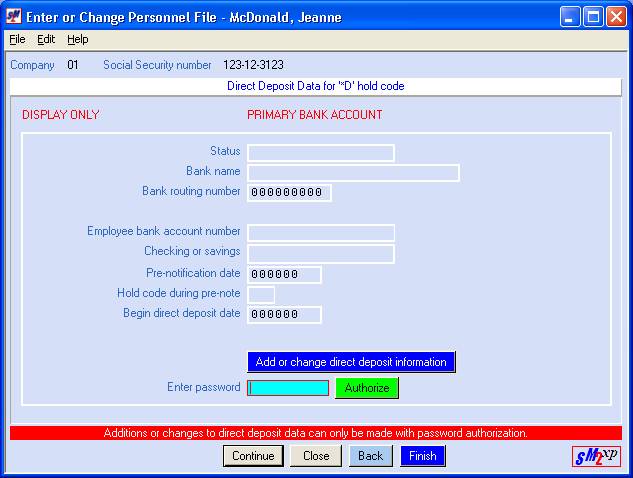

If this employee does NOT

already have direct deposit data, the screen will display:

Regardless of whether the employee already has direct

deposit information or not, the system will require a password to

continue. If you need to change

existing direct deposit data, click the [Add or

change direct deposit information] button to get to the password

area.

Enter Password:

Key the same password that you

use when processing a Begin Cycle for this general ledger company, then click [Authorize].

If you do not know the password, refer to Menu

PBMANT, Item Payroll System Requirements.

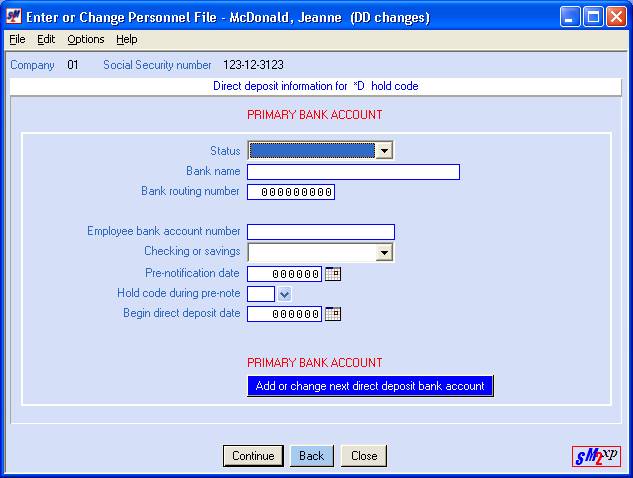

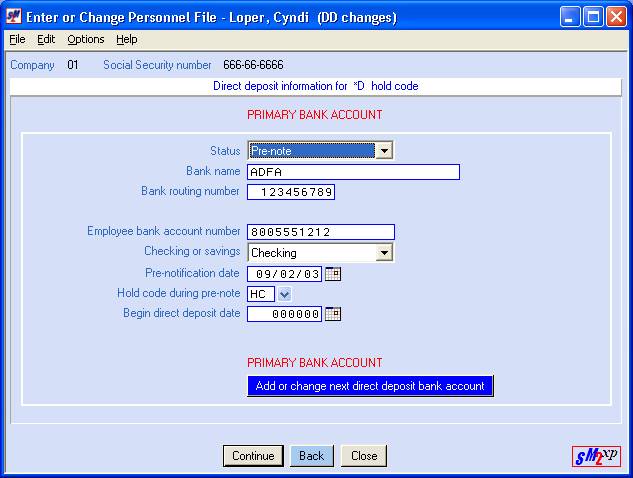

The screen will display the Primary

Bank Account screen. The Primary

bank account will receive 100% of the net pay if it is the only bank

account set up for the employee. If the

Second or Third bank account screens are used, then the Primary account

will receive whatever net pay is left after deposits are made into the other

accounts.

The Primary bank account

screen displays:

If you are updating existing

direct deposit data, the Primary bank account screen will display:

Status:

Select

either Pre-note or Active by clicking the ![]() button (prompt and select button) to the

right of the Status area.

button (prompt and select button) to the

right of the Status area.

Select

Pre-note while in the testing phase of direct deposit for this bank

account. The employee will continue to

receive a printed paycheck while the status is Pre-note.

Select

Active when you are ready to begin depositing net pay to the employee’s Primary

bank account.

Bank Name:

Key the name of the employee's

bank.

Bank Routing #:

Key the 9-digit routing number

of the person's bank.

Employee Bank Account #:

Key up to 17 characters of the

employee's bank account number. If you

do not need all 17 spaces, leave the unused blank spaces to the right of the

account number.

Checking or Savings:

Indicate

whether this is a Checking account or Savings account. Click the ![]() button (prompt and select button) to the

right of the Checking or Savings area.

button (prompt and select button) to the

right of the Checking or Savings area.

Pre-Notification Date:

Key today’s date. Any payroll processed today or after today

will include a pre-note test run of payroll data.

OR

Select a

date by clicking the ![]() button (prompt and select button) to the

right of dates throughout SkilMatch2. The

button (prompt and select button) to the

right of dates throughout SkilMatch2. The ![]() button will display a calendar from which you

may click on a date to select, and then click [OK]

to key the date.

button will display a calendar from which you

may click on a date to select, and then click [OK]

to key the date.

Hold Code During Pre-Note:

Since the employee will continue

to receive a printed paycheck during the pre-note test period, you must add a

valid paycheck hold code to be used during the test period. This code will print on the face of the check,

in addition to the ‘real’ Check Handling code of *D. The only exception to this is when the customer (associated with

the paycheck) has a special Paycheck code.

Key a valid Check Handling code,

OR

Select a

valid paycheck hold code by clicking the ![]() button (prompt and select button) to the

right of the hold code during pre-note area.

button (prompt and select button) to the

right of the hold code during pre-note area.

Begin Direct Deposit Date:

Leave this area blank if the

status selected above shows as PRE-NOTE.

When the pre-note acceptance

period has passed without rejection by the bank, and you are ready to begin the

actual direct deposit of this person's payroll, key the week ending date

that direct deposit should begin. (If

you process a timecard whose week ending is before the date keyed, then the

employee will receive a printed paycheck for that timecard.)

If the employee wants to have

100% of their net pay deposited into the Primary bank account only, click [Continue].

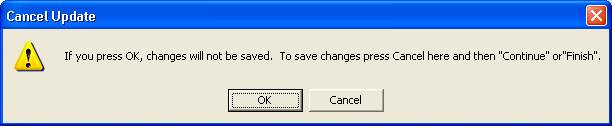

If you do not wish to enter new

direct deposit data, and want to go back and change the hold code to something

other than *D, click [Back].

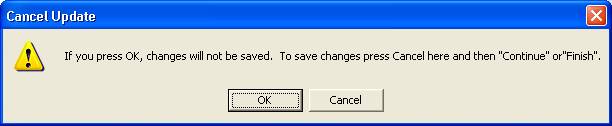

If you click [Close] from this screen, you will be warned

that all changes made will be lost.

Click [OK] if you do not want to save

changes, otherwise click [Cancel].

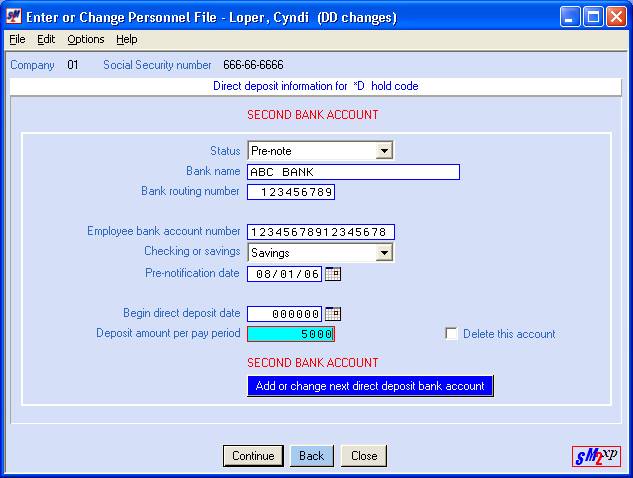

If the employee wants pay to be

deposited into more than one bank account, click [Add OR

change next direct deposit bank account]. The system will bring up a data entry screen

for the SECOND bank account.

The areas are the same on the Second

bank account screen as they are for the Primary Bank account, with the

exception of the Deposit Amount Per Pay Period. Key a specific dollar amount into this

area. During payroll, if the employee

has net pay equal to or greater this amount, then this amount will be deposited

into the Second bank account. If the

net pay for the pay period is less than the amount designated on this screen,

then the entire net pay will be deposited into the Second bank account.

If you want to go back and make

changes to the PRIMARY bank account, click [Back].

If you click [Close] from this screen, you will be warned

that all changes made to the employee screens will be lost. Click [OK]

if you do not want to save changes, otherwise click [Cancel].

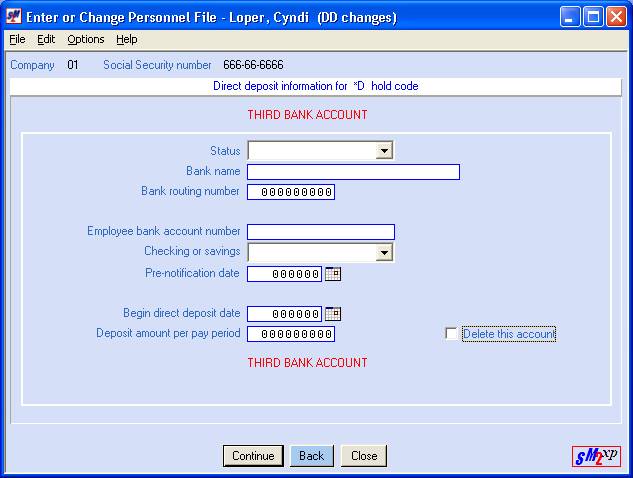

If the employee wants pay to be

deposited into a 3rd bank account, click [Add OR

change next direct deposit bank account]. The system will bring up a data entry screen

for the THIRD bank account.

The areas are the same on the Third

bank account screen as they are for the Second bank account. Key a specific dollar amount into this

area. During payroll, the system will

look at the Second bank account and deposit the amount designated. If there is enough net pay left to cover the

amount designated for the Third bank account, then the full amount will

be deposited to this account. Any

remaining net pay will then be deposited to the Primary account.

If you want to go back and make

changes to the SECOND bank account, click [Back].

If you click [Close] from this screen, you will be warned

that all changes made to any of the employee screens will be lost. Click [OK]

if you do not want to save changes, otherwise click [Cancel].

If you want to add the direct

deposit data from the Primary, Second and Third bank accounts, click [Continue].

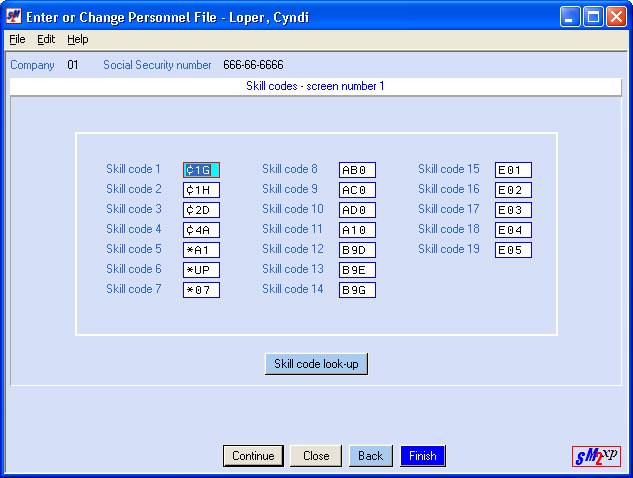

If you clicked [Continue], the screen will display:

Unless there are changes you

wish to make to the remaining screens in the employee file, you should click [Finish] to complete the adding or changing

of this employee’s direct deposit data.

The screen will display:

If you have additional employee

direct deposit data to enter, key the next social security number, and repeat

the preceding instructions. If you have

finished making direct deposit additions and changes, click [Exit].