PAYROLL DEDUCTION CODE EMPLOYEE DETAIL

This option produces a printout of deduction amounts taken from (or added to) employee paychecks for a selected date range. Select a single deduction code, or all deductions. Choose to print check-by-check detail, or a grand total deducted for employee during the time period selected. The report (named PB872) sorts first by deduction code, then alphabetically by employee name.

Deduction report (PB872):

The PB872 Deduction report includes the deduction code and deduction description, the employee social security number, the employee name, the week-ending paid date of the deduction (if detail selected), the deduction amount, and (if applicable), the employer portion of the deduction. There is a total printed at the end of each employee’s detail (if detail selected), and at the end of each deduction code. The last page of the report prints a grand total of all deductions for the G/L Company.

NEW: USE THIS REPORT

for 2013 reporting requirement of NEW ADDITIONAL MEDICARE

TAX (form 941, line 5d)

The

Affordable Care Act requires employers to withhold an additional .9% for

Medicare tax after an individual’s wages exceeds $200,000 in a year (employee

portion only). The full documentation

regarding the Additional Medicare Tax can be accessed here. If your payroll is withholding Additional

Medicare, this report “Payroll Deduction Code Employee Detail” must be run to

determine the Additional Medicare tax withheld.

Determine

if you have withheld Additional Medicare tax and need to report on form 941…

Important:

Review for each payroll company, both temp and staff.

Step 1:

Identify

your Additional Medicare deduction code. This is located on the Payroll System Requirements file in

PayBill, File Maintenance. The

code will be listed on the 3rd page, last field. If NO code is listed, this particular

payroll company has not begun processing/withholding the Additional Medicare

Tax and NO further research is needed.

Check each company number, both temp and staff.

Proceed

to “Step 2” if an Additional Medicare deduction code IS displayed.

Step 2:

If “Step 1” shows a code setup, process the

Payroll Deduction Code Employee Detail report. Key the Additional

Medicare deduction code (located in Step 1), and accurate Week Ending dates for

the quarter. Key “NO” for

additional queries. As needed, repeat for each payroll company, both temp and

staff.

The documentation shown below explains each field.

“NO” Additional

Medicare withholdings:

If you receive a system message, “NO PBMDED records met the parameters….” for this payroll company number; you have no withholdings for this

Additional Medicare tax code and nothing to report on federal form 941. No further steps needed for this payroll

company number.

“YES” Additional

Medicare withholdings: Needs to be reported on Line 5d of Form 941

If you receive a system message, “The

report DEDUCTION REGISTER has been completed…” the report PB872 will be in your spool file. You

will see the Deduction Amount (by employee) and Deduction Total (for

the company) listed. The

company total for Additional Medicare tax will need to be reported on federal

form 941, line 5d.

CALCULATION NOTE: The

amount listed as “Deduction Total” is the amount of Addition Medicare

tax withheld. You will need to

calculate Additional Medicare wage dollars.

This can be done by dividing the “Deduction Total” by .009 (i.e. report

indicates, $45 in Deduction Total, this total divided by .009… $45/.009 = $5,000 Additional Medicare

wages).

Query

Reports:

You will be offered the option of producing a series of (4) Query reports. These reports will only be of use to you under specific circumstances. If your situation matches the following points, then you should select the query reports. If you situation does NOT match the following points, then you should NOT select the query reports:

1) The account number used for a deduction code’s G/L Distribution is an expense account (a 4-digit account greater than 4100), not a liability account (a 4-digit account less than 4000) and,

2) This G/L company has more than one cost center and,

3) The amounts deducted from employee paychecks for an individual deduction code, really belong to more than one cost center and,

4) You are going to make manual G/L journal entries to reallocate the deduction dollars.

Of the (4) Query reports that are created, you will only use two of the four. Everyone will use the first report, which lists the actual G/L accounts used to post the deductions. Of the other 3 reports produced, you will select the one that matches the design of your G/L expense accounts.

With DIV - If the G/L account numbers differ due to the 2-digit Division (cost center) number (like 01-5000-00, 02-5000-00, 03-5000-00) then you will use the DIV query for the journal entries.

With DIV & SUB - If the account numbers differ by both the 2-digit Division (cost center) number and the 2-digit sub-account number (like 01-5000-01, 02-5000-01, 03-5000-01) then you will use the DIV/SUB query for the journal entries.

With SUB - If the account numbers differ by the 2-digit sub account number (like 01-5000-00, 01-5000-01, 01-5000-02) then you will use the SUB query for the journal entries.

For more information on the G/L Distribution records associated with a Deduction code, see P/R G/L Distributions.

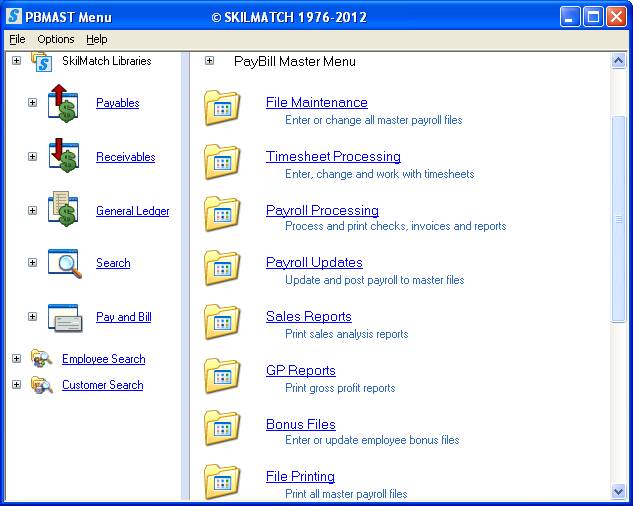

To begin, select the [File Printing] menu in the Pay and Bill library.

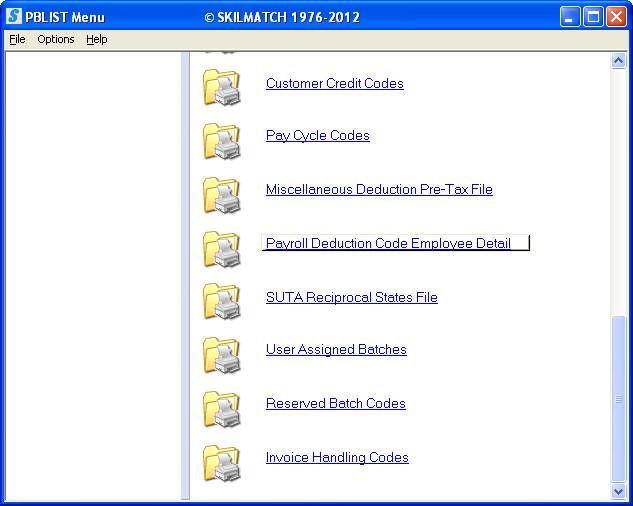

Next, scroll down or right click and select [Payroll Deduction Code Employee Detail].

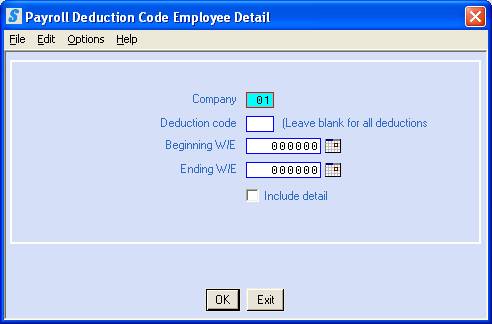

The screen will display:

Enter Company Number:

The system defaults to Company 01. To produce a report for another company, key the desired company number.

Enter Deduction Code:

Key the desired deduction code,

OR

Leave the area blank to include ALL deduction codes.

Enter Beginning W/E:

Key the beginning weekending date,

OR

Select a date

by clicking the ![]() button (prompt and select button) to the

right of dates throughout SkilMatch2. The

button (prompt and select button) to the

right of dates throughout SkilMatch2. The ![]() button will display a calendar from which you

may click on a date to select, and then click [OK]

to key the date.

button will display a calendar from which you

may click on a date to select, and then click [OK]

to key the date.

Enter Ending W/E:

Key the ending weekending date,

OR

Select a date

by clicking the ![]() button (prompt and select button) to the

right of dates throughout SkilMatch2. The

button (prompt and select button) to the

right of dates throughout SkilMatch2. The ![]() button will display a calendar from which you

may click on a date to select, and then click [OK]

to key the date.

button will display a calendar from which you

may click on a date to select, and then click [OK]

to key the date.

Include Detail:

To print check-by-check deduction detail for each employee, select this option by clicking once (a checkmark will appear next to the selection).

OR

To print the deduction totals for each employee, without printing the check-by-check detail, leave this option unselected (no checkmark will appear next to the selection).

To produce the Deduction report, click [OK].

OR

To cancel and return to main menu, click [Exit].

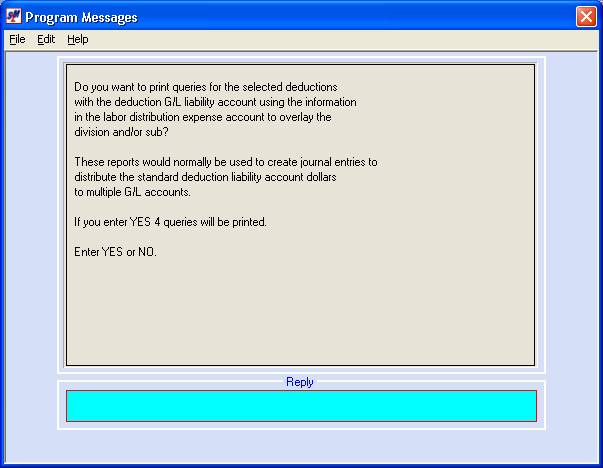

If you select [OK], the following screen will display:

If your accounting department needs to reallocate deductions, key YES and press <Enter>. Four query reports will display in your output queue.

If your account department does not need to reallocate deductions, key NO and press <Enter>.

You will return to the “PayBill Library Payroll Master File Printing” menu. The Deduction report (named PB872), will display in your outqueue. If you selected the query reports, they will display in your outqueue without names.