REVERSE CHECK (AND CORRESPONDING

INVOICES)

This option is used to reverse a check and the associated invoice THAT

HAS BEEN PAID.

This option removes or voids any check AND invoice

data in the system that has not yet been cleared from bank reconciliation.

NOTE: If the check you need to reissue

is for the exact amount of the original check and is to be disbursed and posted

to the same accounts as the original invoice and check, then DO NOT use

this option. Instead, void the check

through Menu

Bank Functions, Item Enter Checks and add the

reissued check data through Menu Bank

Functions, Item Manual Checks.

IMPORTANT: You should post "reversed"

checks to the same fiscal month to which they were written unless the original

fiscal period is in a closed prior year or a closed month that you do not wish

to reopen.

NOTE: If you balance your A/P ageing to general

ledger, the ageing will continue to show the original invoice as ‘open’ up to

the month that the check was written and reversed.

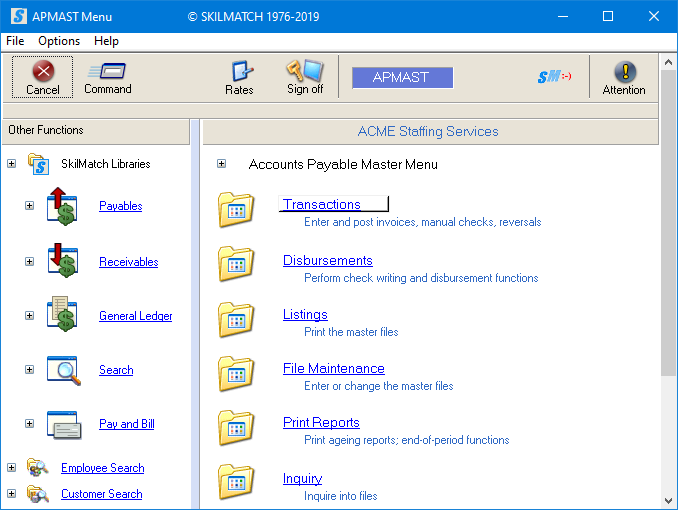

To

begin, select [Transactions] menu in the

Accounts Payable Library.

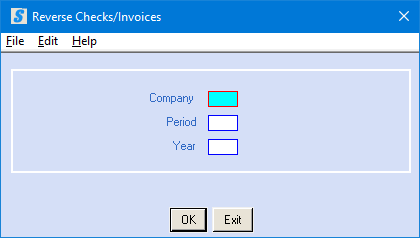

The

screen will display:

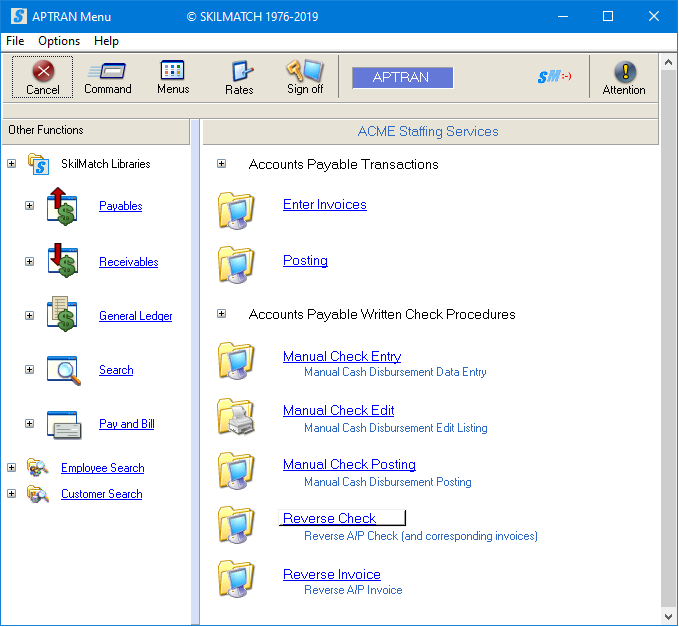

Click

[Reverse Check], the screen will display:

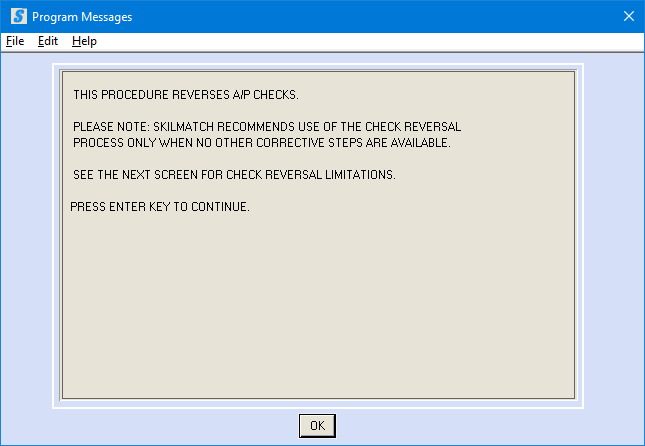

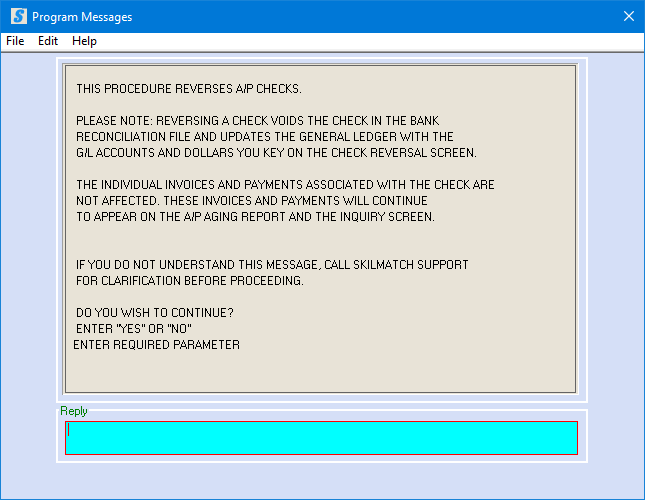

If you select [OK] to

continue, the screen will display:

To cancel reversal, key NO and press [Enter].

OR

To continue reversal of check (and invoice), key YES and press [Enter].

If you keyed YES to continue,

the screen will display:

Company:

Key the desired company number.

Period:

Key the fiscal period associated with the check.

Year:

Key the business year associated with the check.

To cancel and return to menu, click [Exit]. You will be returned to the “Accounts Payable

Transaction Processing” menu.

OR

To proceed, click [OK].

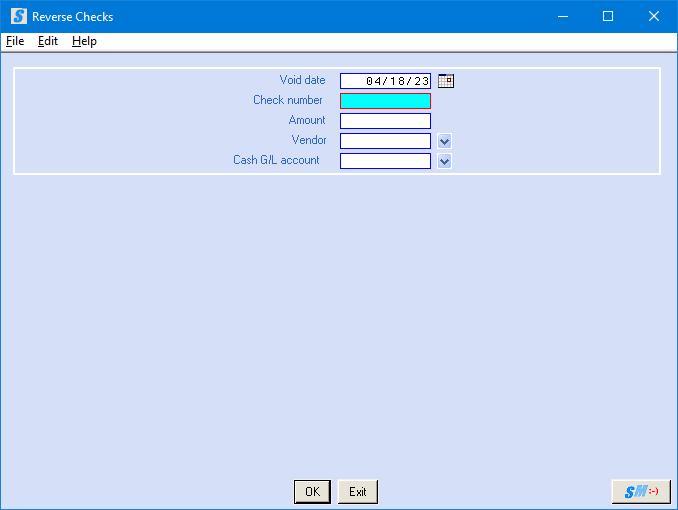

If you select [OK] to

continue, the screen will display:

Void Date:

Defaults to today's date. If you wish to use a void date other than

today, the void date may be keyed (without

punctuation) or may be selected by clicking the ![]() button (prompt and select button) to the right

of dates. The

button (prompt and select button) to the right

of dates. The ![]() button will display a calendar from which you

may click on a date to select, and then click [OK] to key the date.

button will display a calendar from which you

may click on a date to select, and then click [OK] to key the date.

Check Number:

Key the desired check number.

Amount:

Key the check amount.

Vendor:

Key the vendor associated with this check.

Cash G/L Account:

Key the cash G/L account number charged with this check.

To NOT proceed, click [Exit]. You will be returned to the “Accounts Payable

Transaction Processing” menu.

OR

To proceed, click [OK].

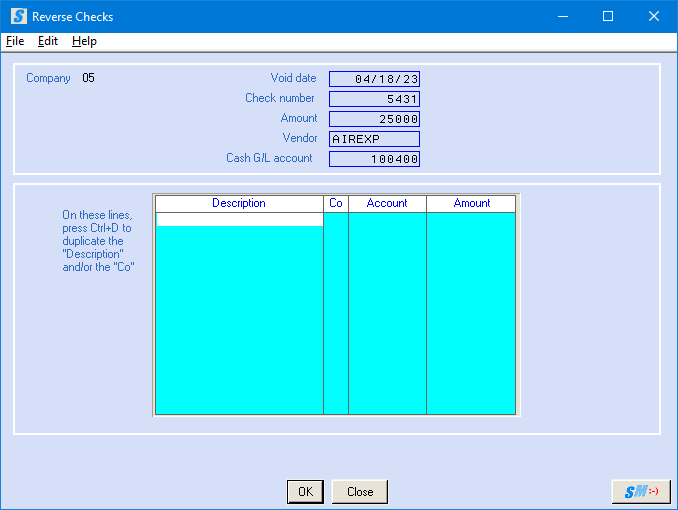

If you select [OK] to

continue, the screen will display:

Description:

(Optional

Entry) Key the description of the

disbursement.

Co:

Key the company number associated with the disbursement.

Account:

Key the G/L account this disbursement was expensed to.

Amount:

Key the disbursement amount.

REPEAT these steps until ALL

the disbursements for this check have been entered.

NOTE: If you have numerous descriptions to enter,

you may use the (Ctrl + D) keys to repeat any identical description or company

number. If you duplicate data by

pressing the (Ctrl + D) keys, you will see symbols, but the system will read

the information from the last field.

NOTE: You may enter up to 13 disbursements. If you have more than 13, then your 13th

disbursement should be a total of the remaining disbursements. You would then "break up" this total

through manual G/L journal entries.

If you decide the information on this screen is incorrect and you wish to

start over with this check, you may click [Cancel]

to exit without reversing this check.

OR

To proceed with the reversal of this check, click [OK].

NOTE: If the

disbursements do not equal the invoice amount, the screen will deliver the

error message “Detail Out of Balance”.

You will not be allowed to continue until the disbursements equal the

invoice amount.

The screen will display a blank screen to allow you to reverse another

check. Repeat these procedures until all

checks you wish to reverse have been entered.

Once you have finished entering all desired checks, click [Exit].

No edit is produced for your review. The entered checks

will be reversed immediately.

You will be returned to the “Accounts Payable Transaction Processing”

menu.

Reports:

The Cash Disbursements Journal--Check Reversals (APCKRV) can be

found in your output queue. This report

should be retained in your A/P book, Cash Disbursements section.

Programmer's Notes:

This option voids the check in the bank rec file and writes records to

the general ledger distribution file based on the account numbers keyed on the

distribution screen.

There is NO EFFECT on the invoice file, this means:

(1) Invoices will need to be re-entered if they need to

be paid.

(2) Invoices and payments will continue to display on

the inquiry screen. If the invoice is

re-entered to be paid, the invoice will display twice on the inquiry screen.