LIST CHECKS, Accounts Payable

Prints a list of:

·

Checks

entered through options Enter

Checks and Cancelled

Checks

·

Any

checks considered still outstanding as of a certain date

·

Voided

checks not cleared from the system

This report is your written verification of check entries made through Menu Bank

Functions, Item Enter Checks and Menu Bank

Functions, Item Cancelled Checks.

Scrutinize

this report carefully for accuracy prior to updating the check file through

Menu Bank

Functions, Item Update Check File.

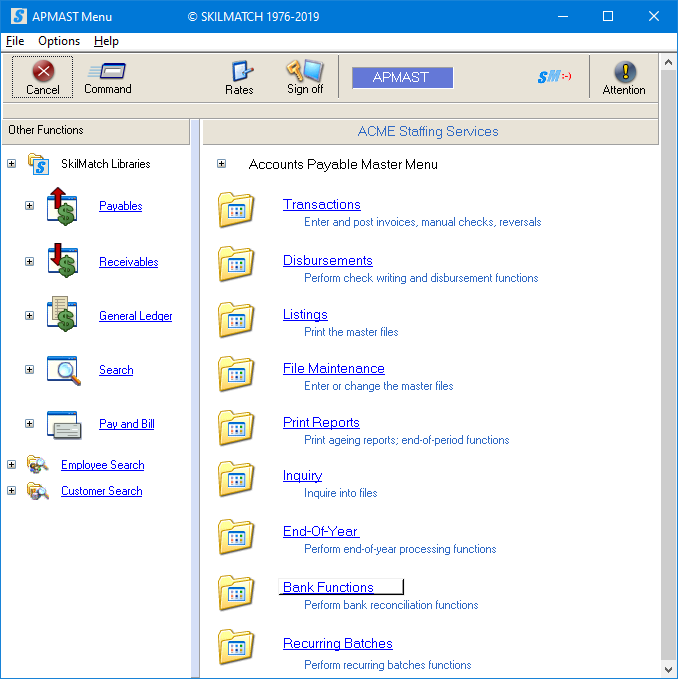

To begin, select the [Bank Functions] menu in the Accounts Payable library.

The screen will display:

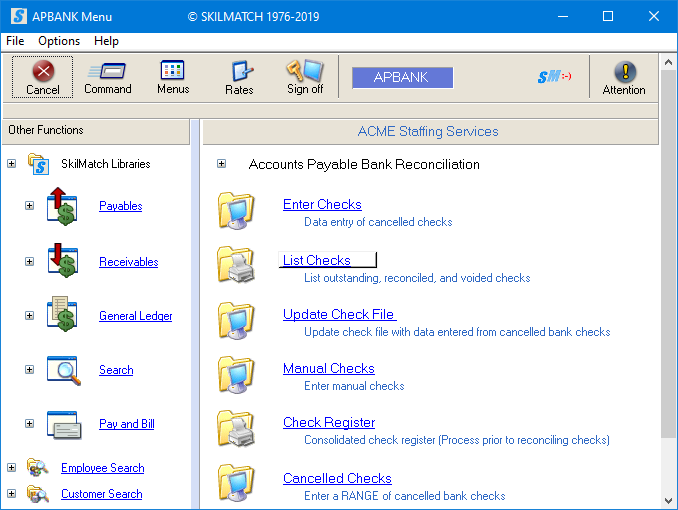

Click [List Checks], the screen will display:

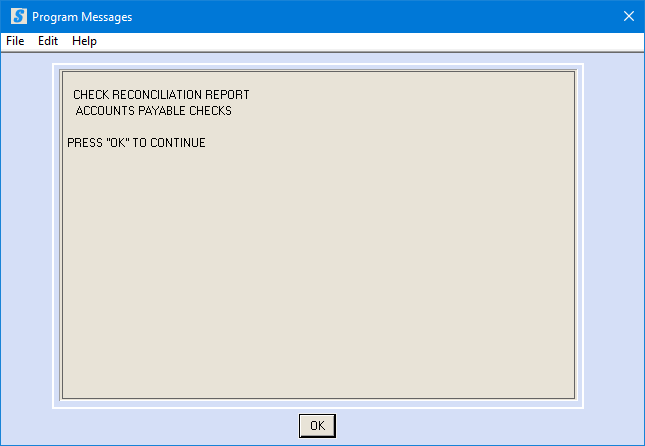

Click [OK],

the screen will display:

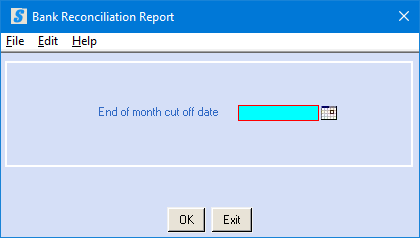

End Of Month

Cut Off Date:

The end of month cut off date (date of the

bank statement to which you are balancing) may be keyed (without punctuation) as

a six-digit (MMDDYY) date of the last day of the period/year you selected.

OR

Select date by

clicking the ![]() button (prompt and select) to the right of

dates and a calendar will display from which you may click on a date to select,

and then click [OK] to bring the calendar date

into the date field.

button (prompt and select) to the right of

dates and a calendar will display from which you may click on a date to select,

and then click [OK] to bring the calendar date

into the date field.

To proceed, click [OK]. Your screen will remain “input inhibited”

(tied up) while the option processes.

When processing has completed, you will be returned to the “Accounts

Payable Bank Reconciliation” menu.

OR

To cancel and return to menu, click [Exit].

If you click [Exit] to

cancel, the screen will display:

Click [OK]

to continue. You will be returned to the

“Accounts Payable Bank Reconciliation” menu.

Report Produced:

Review Bank Reconciliation report

(AP610P) and make changes as needed, see “Errors on

Report” below.

The Bank Reconciliation report (AP610P) will display vendor

code, vendor name, check date, check number, check amount, and a void date,

where applicable.

The check amount will appear under one of three column headings--Outstanding,

Reconciled, or Void.

Any check in the system that was not cleared in a previous reconciliation

or was not entered in Menu Bank

Functions, Item Enter Checks will appear under the

outstanding column.

Any check that was entered in Menu Bank

Functions, Item Enter Checks to be cleared will

appear under the reconciled column.

Any check entered with a void code will appear under the voided column.

Any check entered with a deleted code will moved back to the outstanding

column.

NOTE: If

the check amount entered in Menu Bank

Functions, Item Enter Checks differs from the amount

issued by the system, both amounts will appear on the report. The SkilMatch issued amount will appear under

outstanding, and the bank issued amount entered through Menu Bank

Functions, Item Enter Checks (the bank code amount) will appear under reconciled. A message will appear to the side that

reads: *AMTS NOT EQUAL*. You must make

adjustments to the general ledger that will account for this difference.

The bank reconciliation

report is broken into sections according to bank account number, and the last

line of each section displays separate bank account totals for outstanding

checks, reconciled checks and voided checks.

NOTE: If you have check amounts that differ between

what the bank charges and what the system issued, the outstanding column total

will not include that check amount even though it is displayed as a dollar

figure within that column.

Errors on

Report:

If you find errors on the Bank Reconciliation report (AP610P),

go back to Menu Bank

Functions, Item Enter Checks. Follow the procedures as if you were entering

a new check number. The system will

display what you entered previously. Key

over/replace information shown with the correct information, examples below.

CHECK

SELECTED IN ERROR: To remove this check from the reconciled

list, change the code to Deleted.

WRONG

DOLLAR AMOUNT ENTERED: If you have entered a wrong amount or code, <tab>

to the field and key over the existing information with the correct information.

When the information for the check is correct, click [OK]. When you have made all corrections, click [Exit]

to end the job.

REPEAT: You

should print another Bank Reconciliation report Menu

Bank Functions, Item List Checks to inspect the

changes made.