INTRODUCTION

TO SETTING UP THE GENERAL LEDGER

The following steps should be

taken to set up the general ledger in SkilMatch.

1. Design (but do not enter)

general ledger account numbers (refer to document Menu

GLMANT, Item Accounts.

2. Design (but do not

enter) your financial statement tailoring (refer to document Menu

GLMANT, Item Tailoring).

3. Enter company names (refer to

document Menu

GLMANT, Item Company).

4.

Create and enter names for the cost centers (refer to Menu

GLMANT, Item Cost Center Descriptions).

5. Enter general ledger account

numbers for the balance sheet accounts and one cost center (refer to document Menu

GLMANT, Item Accounts).

6. Use the system to create the

additional cost center account numbers (Menu

GLMANT, Item Copy Chart of Accounts).

7. Add and delete account

numbers to the completed Chart of Accounts (Menu

GLMANT, Item Accounts).

8. Enter financial

statement tailoring (refer to document Menu

GLMANT, Item Tailoring).

9. Set retained earnings numbers

for current and prior year earnings (refer to Menu

GLMANT, Item Retained Earnings).

10. Set group number for

percentage calculations (refer to Menu

GLMANT, Item Set Group).

11. (Optional) Establish

consolidations (company and/or cost center) (refer to Menu

GLMANT, Item Consolidations or Menu

GLMANT, Item Division Consolidation).

12. Enter budget and/or prior

year data (refer to Menu

GLMANT, Item Budgets and Prior and Menu

GLMANT, Item Duplicate Budget).

13. Activate budget and/or prior

year data (refer to Menu

GLMANT, Item Activations).

14. (Optional) Enter beginning

balances (refer to documentation concerning ‘Beginning Balances in General

Ledger’ in document Menu

GLJOUR, Item Data Entry).

15. (Optional) Maintain valid

posting periods for all SkilMatch accounting applications. (refer to Menu

GLMANT, Item GL Posting Periods)

HOW TO MAINTAIN TAILORING FILE RECORDS

Use this option to add or change

financial statement format (tailoring) information.

“Tailoring” refers to the design

of your balance sheet and income statement.

There are 3 basic elements to a financial statement. HEADINGS: the words that describe what is to

be printed (like Current Assets); SUMMARY: words that describe the dollars to

be printed (like Cash in bank); and TOTALS: the adding of figures to make

totals.

You should begin this process

with a sample of a summarized balance sheet and income statement for a single

cost center, and one for G&A. On

the samples, assign a number to each printed line in sequential order.

For the balance sheet,

start with 0050 and continue through 3999.

Skip numbers as you go along, to leave room for additional lines in the

future.

Example:

Assets 0050

Current assets 0100

Cash in bank 0150

Accts Recv 0200

Prepaid Expense 0250

Total Current 0400

For the income statement,

start with 4100 and continue through 9999.

Skip numbers as you go along, to leave room for additional lines in the

future. Example:

Income 4100

Temporary sales 4150

Direct hire fees 4200

Billed expenses 4250

Total sales 4500

Financial statements do NOT

print in order by general ledger account number, but by group number. A “”group” is a series of one or more like

accounts (Like Payroll cash account, Operating cash account, Savings account;

or federal withholding payable, FICA payable, and Medicare payable).

You have a choice when printing

financial statements of printing a Summarized version that follows the

tailoring (Cash in bank – with a grand total of all cash accounts in the group)

or a Detailed version (prints a separate line for each account in the

group – Payroll account, Operating account, etc.)

You will also have the

opportunity to assign indentions to each line, and to control the insertion of

blank lines wherever you like.

After you have completed the

design on paper, you will need to back to the Chart of Accounts option and add

the group numbers to every account in your chart of accounts through Menu

GLMANT, Item Accounts.

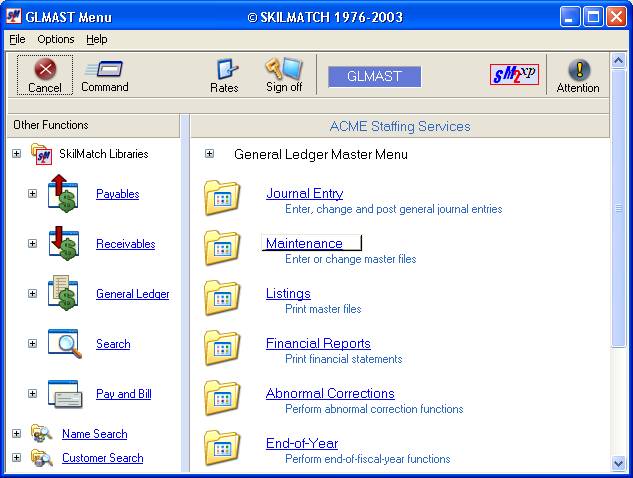

To

begin, on the “General Ledger Master” menu, click [Maintenance].

The screen will display:

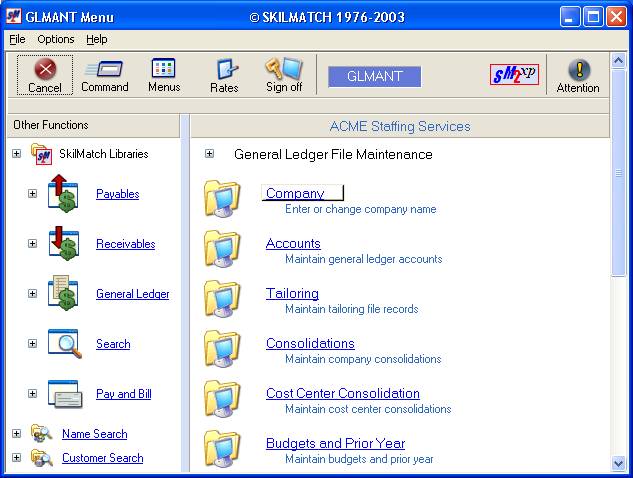

Click [Tailoring].

The screen will display:

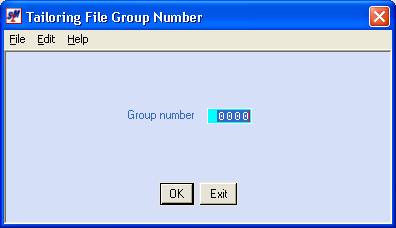

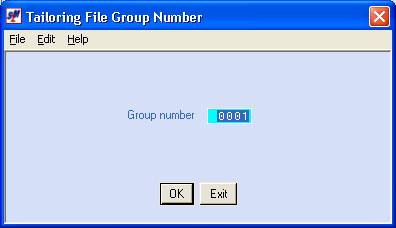

Group Number:

A “group number” simply refers to a number assigned to a line that is to print on your financial statements. By numbering lines in numerical order, you are instructing the program the order in which to print the lines of your statement.

You will NOT have a

separate group number for each account number. Many accounts will belong to the same group,

other groups will only have a single account.

Remember that Balance Sheet accounts belong to group numbers 0001-3999. Income and expense accounts belong to groups

4100-9999. (Do NOT use group numbers 4000-4099).

Key an existing group number

that you wish to change.

OR

Key a new group number that you

wish to establish.

To proceed, click [OK].

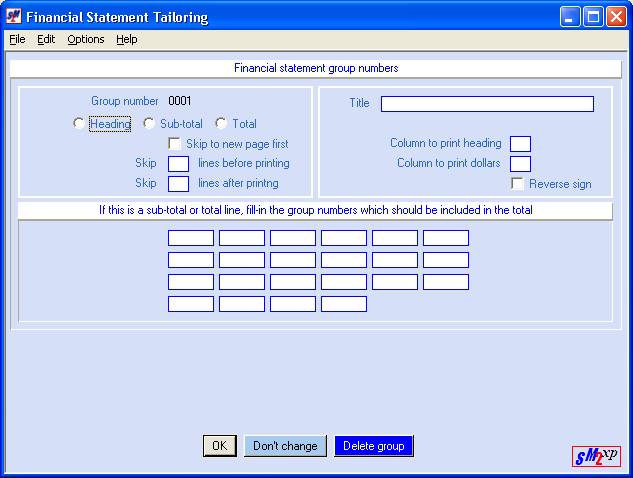

The screen will display:

HEADING/SUB-TOTAL/TOTAL:

Choose one of these 3 choices to

establish what kind of element this group number will represent.

HEADING is

strictly a title - there are no dollars associated with it (like CURRENT

ASSETS).

SUB-TOTAL means

there will be one or more account numbers with dollars belonging to this group

(like CASH IN BANK).

TOTAL will

combine up from 1 to 22 SUBTOTAL groups together as a single figure (like TOTAL

CURRENT ASSETS).

Select

one of these 3 choices, and press the <TAB>

key for additional keying.

Skip to New Page First:

If you wish to begin a new page

when this group number prints, click this selection. A black dot will appear.

If you do NOT wish to begin a

new page, leave this area blank.

Skip Lines Before Printing:

Key the number of blank lines to

be inserted before printing this line.

Select 0, 1, 2, or 3.

Note: if you enter 0, then you must enter 1,2, or 3 in the area Lines

After.

Note: if you enter 1 in both Lines Before and

Lines After, the system will double-space before and after the line is printed.

Skip Lines After Printing:

Key the number of blank lines to

be inserted after this line is printed.

Select 0, 1, 2, or 3.

Note: if you entered 0 in the Lines Before area, you must key 1, 2, or 3.

Title:

Key a title or description for

this group. There are 25 characters

available. If you do not wish to have a

title, key a ‘.’ (period).

Column To Print Heading:

You have a choice of three

indentions for the TITLE.

1

prints the title against the left margin.

2

indents three spaces before printing the title.

3

indents six spaces before printing the title.

Column To Print Dollars:

You have a choice of three

indentions for the DOLLARS.

1

indents to the middle of the page before printing the dollars.

2 indents to the right of position 1.

3

indents to the right of position 2.

Reverse Sign:

If this group number prints

dollars, selecting this area will causes the amount's sign to be reversed.

Example: credit balances are negative numbers and

debit amounts are positive numbers.

Therefore, credit balances will appear with a negative sign (-), and

debit amounts will print without a (-) unless you select this area.

Note: generally, liability accounts have reversed signs.

If This Is A Total Line. Fill In The Group Numbers Which Should Be

Included In The Total:

If this is a Total line, key the

group numbers whose sums are to be added together. You may enter up to 22 group numbers, and they must be keyed in

numerical order. We suggest that if you

have more than 22 group numbers that need to be added together for a grand

total, that you find a way to divide them into smaller groups that have a

Heading, then add together these smaller groups into a total line.

For example – don’t have an

all-inclusive Heading that reads EXPENSES and lists all expenses

alphabetically. Instead, break them

into smaller groups like Recruiting Expenses (advertising, marketing, customer

and employee gifts), Operating Expenses (like rent, utilities, telephone)

etc. Then you can form a Total Line

group that will add these individual groups.

Do NOT leave any blank spaces! Your total line will not calculate correctly

if there are

Include only group numbers that

are lower than the group number displayed at the top of the screen.

If

you are satisfied with the setup displayed, click [OK].

Note: if you have neglected to fill in all the necessary

fields, the screen will display the error, and you may move the cursor to the

appropriate field to make the entry.

If at any time you wish

to discontinue this entry and erase everything you keyed on this particular

group number, click [Don’t change]. The system

will return to menu without updating the files.

If at any time you wish

to delete this entry and erase everything you keyed on this particular group

number, click [Delete

this group]. The system will delete

this group number and return to menu.

Note: If the group

you are deleting has been assigned to account numbers, you will need to go to

the account and change to a valid group number.

Repeat the preceding

steps until all statements are tailored to your satisfaction. Click [Exit]

to end the job and return to menu.

The screen will display:

Click [OK]. You will receive an edit report. Verify the accuracy of the entries. If everything appears correct, you are

finished with this option. If you see

errors, you must re-enter the option to make corrections.