INTRODUCTION

TO SETTING UP THE GENERAL LEDGER

The following steps should be

taken to set up the general ledger in SkilMatch.

1. Design (but do not

enter) general ledger account numbers (refer to document Menu

GLMANT, Item Accounts.

2. Design (but do not enter)

your financial statement tailoring (refer to document Menu

GLMANT, Item Tailoring).

3. Enter company names (refer to

document Menu

GLMANT, Item Company).

4.

Create and enter names for the cost centers (refer to Menu

GLMANT, item Cost Center Descriptions).

5. Enter general ledger

account numbers for the balance sheet accounts and one cost center (refer to

document Menu

GLMANT, Item Accounts).

6. Use the system to create the

additional cost center account numbers (refer to document Menu

GLMANT, item Copy Chart of Accounts).

7. Add and delete account

numbers to the completed Chart of Accounts (refer to document Menu

GLMANT, item Accounts).

8. Enter financial statement

tailoring (refer to document Menu

GLMANT, Item Tailoring).

9. Set retained earnings numbers

for current and prior year earnings (refer to Menu

GLMANT, Item Retained Earnings).

10. Set group number for

percentage calculations (refer to Menu

GLMANT, Item Set Group).

11. (Optional) Establish

consolidations (company and/or cost center) (refer to Menu

GLMANT, Item Consolidations or Menu

GLMANT, Item Division Consolidation).

12. Enter budget and/or prior

year data (refer to Menu

GLMANT, Item Budgets and Prior and Menu

GLMANT, Item Duplicate Budget).

13. Activate budget and/or prior

year data (refer to Menu

GLMANT, Item Activations).

14. (Optional) Enter beginning

balances (refer to documentation concerning ‘Beginning Balances in General

Ledger’ in document Menu

GLJOUR, Item Data Entry).

15. (Optional) Maintain valid

posting periods for all SkilMatch accounting applications (refer to Menu

GLMANT, Item GL Posting Periods).

HOW TO MAINTAIN GENERAL LEDGER ACCOUNTS

Use this option to enter new

account numbers, change the descriptions and group numbers on existing

accounts, and to delete accounts that have had no transaction records for the

current or prior years.

Note: do not delete account numbers that have transactions for

the fiscal year. If you inadvertently delete an account that has had activity,

then you will not be able to print a financial statement. You would receive an

error report that lists the account number(s) that were deleted. Simply re-add the account(s) using this menu

option to correct the problem.

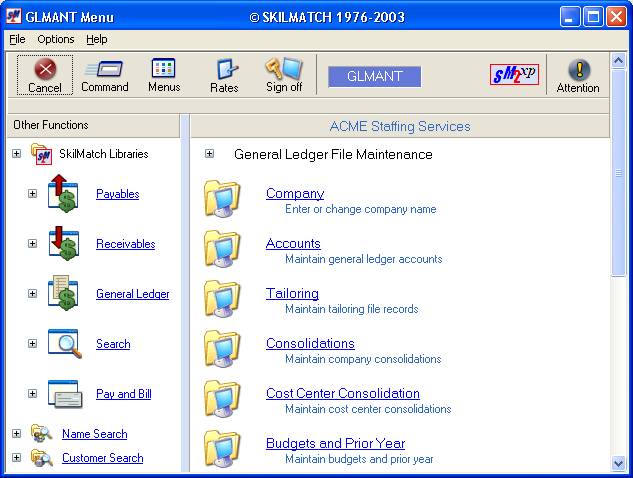

To

begin, on the “General Ledger Master” menu, click [Maintenance].

The

screen will display:

Click [Accounts].

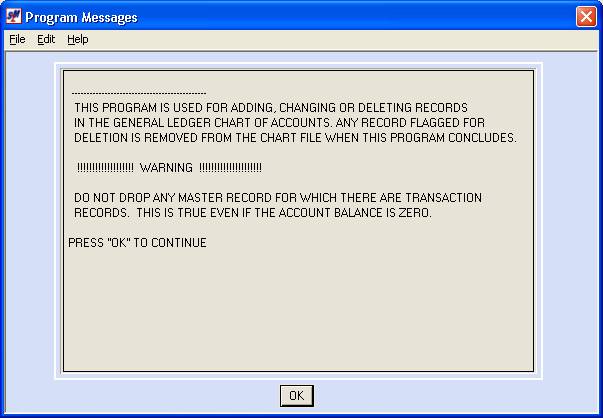

Screen will display:

Read this message then

click [OK] to continue.

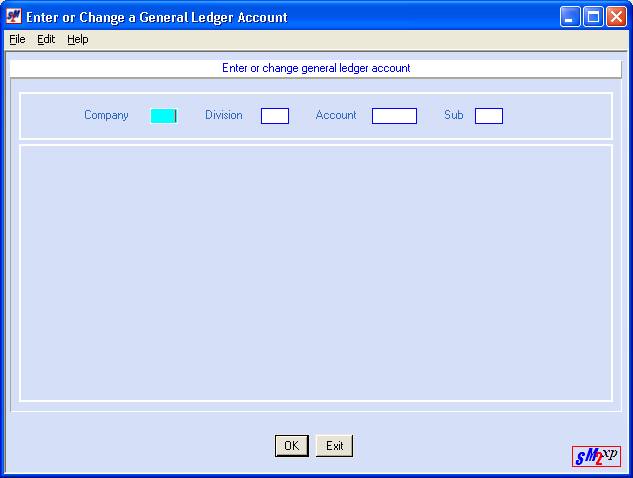

The screen will display:

If you plan to process financial statements that consolidate 2 or more G/L companies, then the Disions/Account/Sub account numbers in each company must be IDENTICAL for like accounts.

Company:

Key a valid company number. (To be “valid” you must have previously

created the G/L company number and name.)

Division:

Key 00 if this is a balance

sheet account.

Key

01-89 for income and expense accounts.

Typically, division 89 is

reserved for general and administrative income and costs.

Note: do NOT

use numbers 90 and above for divisions.

Note: this division number is

the numeric representation of a cost center.

Account:

Key a 4-digit account number.

Balance sheet accounts

must range between 0001 to 3999

Income & expense

accounts must range between 4100 to 9999.

Do

not assign account numbers 4000 through 4099 – if you do, your financial statements will not

paginate properly nor have the correct titles.

Typical

account numbering:

1000s Asset accounts

2000s Liability accounts

3000s Equity and Retained Earnings accounts

4000s Income/Sales accounts

5000s Direct Cost of Sales accounts (wages,

payroll taxes, workers comp)

6000s Staff payroll accounts

7000s Expense accounts

8000s “Other” income accounts

Sub:

Key a sub-account number, if

applicable. You may select from 00 to 99.

There are several potential uses

for the sub account area.

First of all – 00 is the number

to use if you have no use for sub accounts.

Potential Uses:

SALES: Sub-account numbers can let you recognize

accounts that are similar, yet preserve the individuality of each balance for

accounting purposes. For example

different kinds of sales.

Example, if 4100 is the account

for temporary sales, you might use sub-account to represent the type of

temp sales (like 01 for clerical, 02 for industrial, 03 for technical). Most

customers, however, use unique account numbers for each sales account, rather

than sub accounts. (4100 for Clerical sales, 4105 for Industrial sales, etc).

WAGE EXPENSE: While many customers break their sales

into different types (temporary and payrolling, or office support and

industrial), most customers do not break out the wage expense into these

same types. However, if you want the

wage accounts to have a similar breakout by type of sale, then you will set up

multiple wage accounts, each with its’ own sub account number. Use the same sub-account numbers on like

accounts. Example, if sub-account 01 is to represent Temporary sales, then you

might have a sales account of 4100-01, and a wage account of 5100-01, etc.

(Posting to different wage expense accounts is activated by the PR Labor

Distributions)

PAYROLL TAX EXPENSE: Also, while many customers break their sales

into different types (temporary, payrolling, inhouse, and more), and a few also

break out the wage expense, most customers do not break out payroll tax

expenses into the same types (temporary, payrolling, inhouse) – all payroll tax

expenses get posted to individual accounts (FICA, medicare, FUTA, SUTA, and

workers’ comp). If you want these

payroll tax accounts to have a further breakout by type of sale, then you will

set up multiple accounts for each kind of payroll tax, each with its’ own sub

account number. Use the same

sub-account numbers on like accounts. Example, if sub-account 01 is to

represent Temporary sales, then you would have a sales account of 4100-01, and

a FUTA account of 5130-01, etc.

(Posting to payroll tax sub-account is activated in the PR GL

Distribution file).

REIMBURSED TEMP EXPENSE: The system will use a single account number

(of your choice) for the posting of expenses reimbursed to temporaries through

payroll. This means that all types of

reimbursed expense would end up in the same pool. If you prefer to break out reimbursed expenses into different

kinds of expenses, then you would create multiple accounts using the same

4-digit account number, but have unique sub-account numbers. (Posting to

reimbursed temp expense sub-account is activated in the PR System Requirements

file.)

BILLED EXPENSE ACCOUNT: The system will use a single account number

(of your choice) for the posting of expenses billed to customers through

payroll. This means that all types of

reimbursed expense would end up in the same pool. If you prefer to break out billed expenses into different kinds

of expenses, then you would create multiple accounts using the same 4-digit

account number, but have unique sub-account numbers. (Posting to billed

customer expense sub-account is activated in the PR System Requirements file.)

BONUSES: The system will use a single account number

for the posting of Holiday pay and Lunch bonus pay. If you prefer to break out these bonuses between accounts, then

you would create multiple accounts using the same 4-digit account number, but

have unique sub-account numbers. (Posting to multiple Holiday and Lunch bonus

expense sub-accounts is controlled by the Bonus Requirement Master file.)

NOTE-- If you plan

to use sub accounts for more than 1 of the uses described above, then the sub

account meaning must be identical for each use. (01=clerical, 02=industrial, or

01=temp, 02=payrolling, etc).

INTERFACE TO NGS: If you have more than 89 cost centers, and

interface to NGS for general ledger, then you cannot use any

of the first 6 uses - your sub-accounts are reserved for expansion to over 89

cost centers.

To proceed, click [OK].

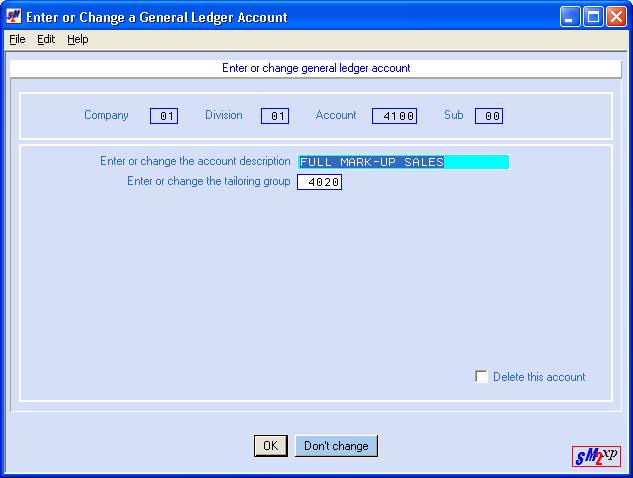

The screen will display:

Note: if

this is an existing account, the screen will display the description and the

group number.

Enter Or Change The Account

Description:

Key up to 25-characters of an

appropriate description for this account or make any changes to the existing

description.

Press

the <TAB> key for additional keying.

Enter Or Change The Tailoring

Group:

Every account number is assigned

to a tailoring group for financial statement printing purposes.

Key the group number to which

this account should belong.

Review existing group

numbers from your tailoring file through Menu GLLIST, option Tailoring.

Press

the <TAB> key for additional keying.

Delete:

If this is an active account,

leave this option unselected (no checkmark will appear next to the selection).

If you wish to delete this

account, click once on this option to select (a checkmark will appear next to

the selection).

Note: do NOT delete an account that has

transaction records even if the account balance is zero. If there has been any activity with this

account, do NOT delete it.

To proceed, click [OK].

Note: if you

do NOT wish to add this account or to make changes to it, press [Don’t

change] to bypass this screen without

updating. You will be returned to the

previous screen where you may continue with a different account number.

When you click [OK], this account will be added to your

chart of accounts and the screen will return you to company on the first screen

of the account number entry.

The screen will display the last

account number entered. If you have

additional account numbers to add or update, <TAB>

or key over the displayed number with the next number and follow the preceding

steps.

When you have finished updating

the accounts, click [Exit] to end the job.

You will return to the “General

Ledger Maintenance” menu.